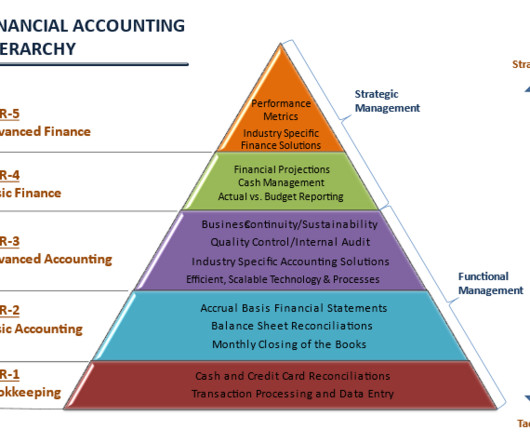

Financial Accounting Hierarchy - By JP Puchulu

Boston Startup CFO

APRIL 3, 2023

This includes reconciling cash and credit card transactions, processing and documenting financial transactions, and inputting the data into your startup’s accounting software. In this tier, a double-entry accounting system is employed to ensure the accurate recording of all transactions.

Let's personalize your content