FP&A’s Scope: What Is In And What Is Out?

Fpanda Club

JANUARY 23, 2025

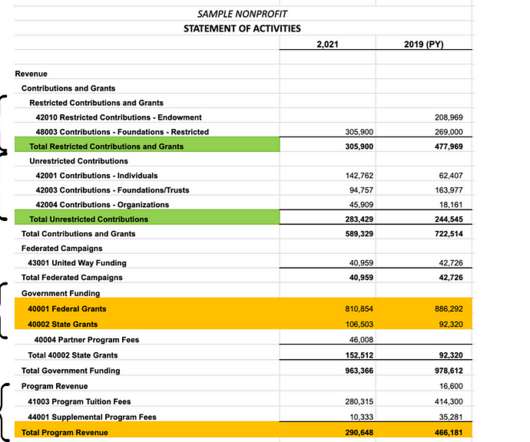

Such tasks as reconciling accounts, monthly closing, preparing financial statements are part of the accounting cycle and are typically managed by accounting departments. Yet, many organizations exclude FP&A from these discussions, leaving marketing or sales teams to make decisions without a detailed financial perspective.

Let's personalize your content