How to maximize efficiency with nonprofit accounting software

The Charity CFO

APRIL 20, 2023

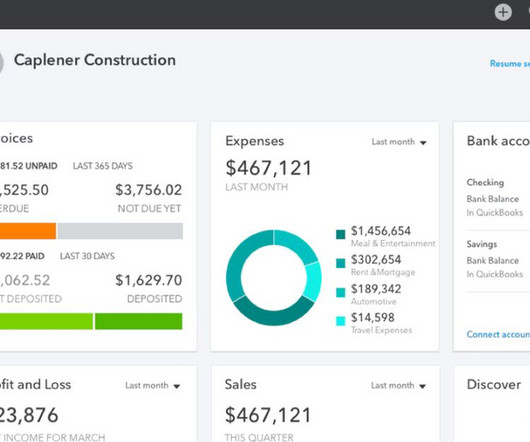

However, nonprofit organizations face unique accounting challenges and not all commercial accounting software may be equipped to handle. Where to start with nonprofit accounting software Nonprofits have to comply with strict financial accounting standards.

Let's personalize your content