How to Handle Deferred Revenue

VCFO

JANUARY 18, 2024

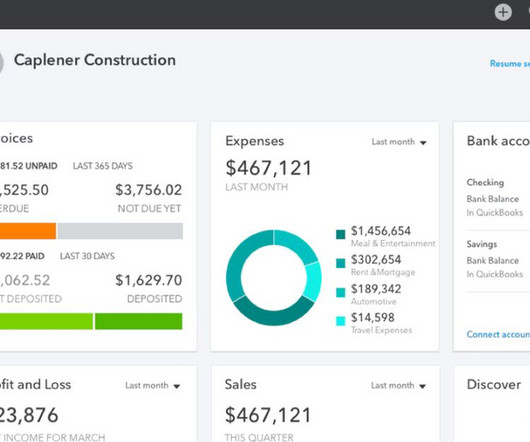

Businesses that regularly contend with deferred revenue include subscription- or license-based businesses (like SaaS organizations or content streaming services), construction, professional services, or property management firms issuing rental agreements. As the points suggest, deferred revenue isn’t just an accounting issue.

Let's personalize your content