Tips for cash management for a nonprofit organization

The Charity CFO

MAY 19, 2023

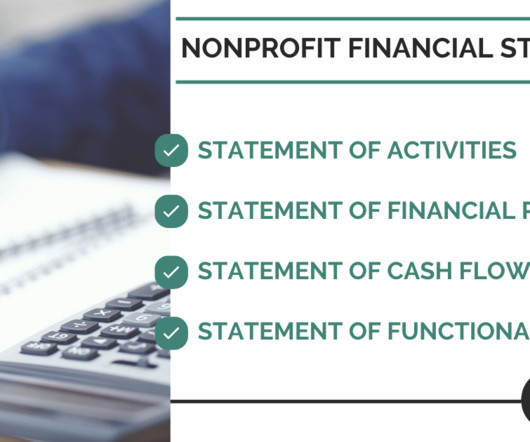

Cash management for a nonprofit organization is possibly the most important consideration for success. In this article, we will build upon that knowledge and delve more specifically into the topic of cash management. What is cash management?

Let's personalize your content