Musings on Markets: A Return to Teaching: The Spring 2023 Edition

CFO News Room

DECEMBER 22, 2022

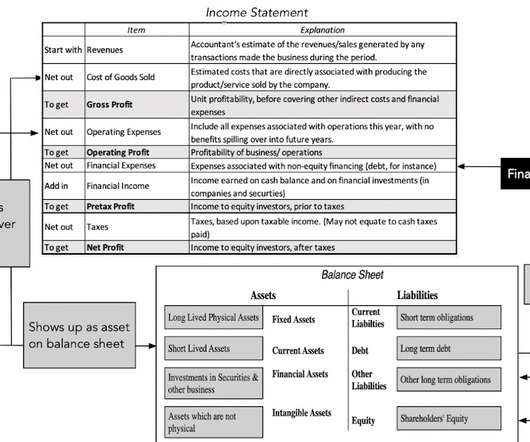

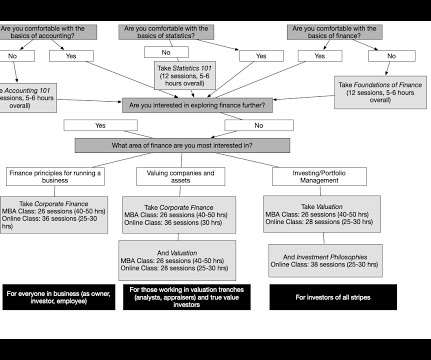

If your query is why I would continue to teach rather than seek out more lucrative careers in investing or banking, my answer is a simple one. Just as a note of warning, this is my quirky version of accounting, and I don’t follow the accounting script in this class.

Let's personalize your content