Performance Advertising Under the SEC’s Marketing Rule

CFO News Room

DECEMBER 7, 2022

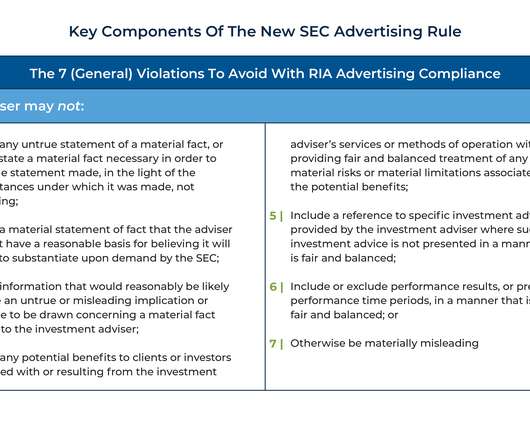

For investment advisers looking to attract prospective clients, advertising the performance of their investment strategies would be a logical way to market their services (at least if they had strong historical returns!). Executive Summary.

Let's personalize your content