Taking a strategic approach to AI adoption

Future CFO

FEBRUARY 14, 2025

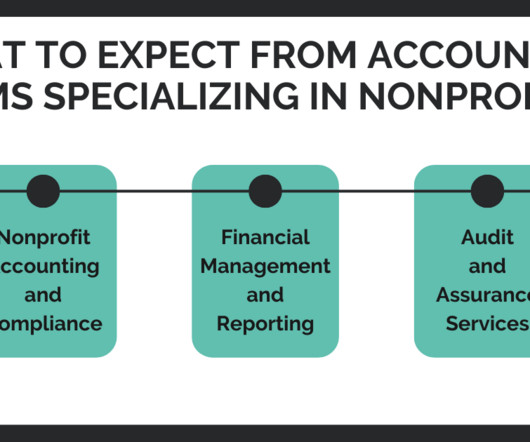

Cloud-based financial systems have improved collaboration, making data more accessible while ensuring compliance with evolving regulations." Understanding automation tools is also essential, as AI is reshaping processes such as financial planning, risk management, and audit compliance."

Let's personalize your content