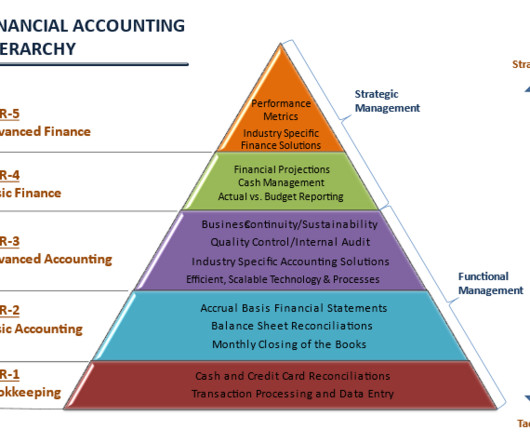

Financial Accounting Hierarchy - By JP Puchulu

Boston Startup CFO

APRIL 3, 2023

Additionally, you open yourself up to compliance and audit issues, and you’ll potentially decrease your chances of securing funding and financing. Here, you’ll want to consider the implementation of efficient, scalable technology and processes to drive growth and maintain a competitive edge.

Let's personalize your content