Nonprofit Accounting Basics for Founders, Board Members & Executives

The Charity CFO

JANUARY 17, 2022

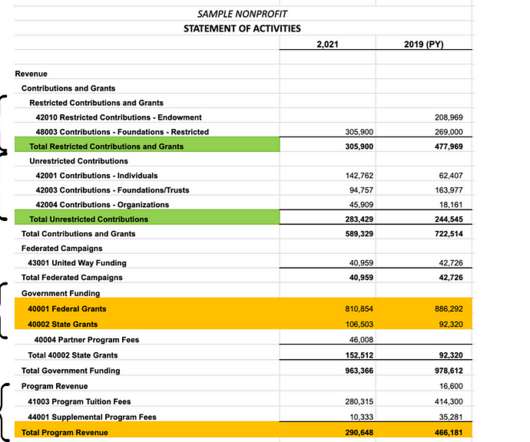

And then, there are a series of reports and financial statements you’ll use to communicate the financial reality of your organization to potential donors, the IRS, watchdog agencies, and other stakeholders. The basic accounting principles for nonprofit organizations are the same as accounting for for-profit companies. .

Let's personalize your content