The five biggest challenges for revenue recognition in 2025

Future CFO

APRIL 9, 2025

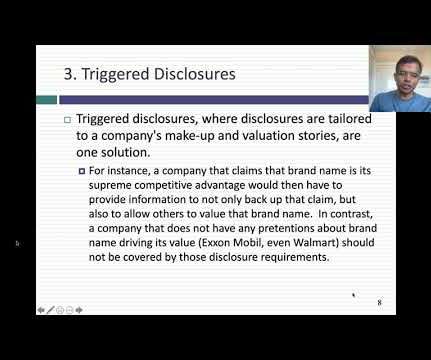

Compliance with standards like ASC 606 and IFRS 15 is still crucial, but the focus has shifted to optimising operations for growth. For many organisations, revenue recognition is a strategic function that impacts forecasting, investor relations, and the companys financial health report. Inaccurate forecasting and reporting.

Let's personalize your content