Where APIs Fall Short On Corporate Finance Integration

PYMNTS

JANUARY 25, 2019

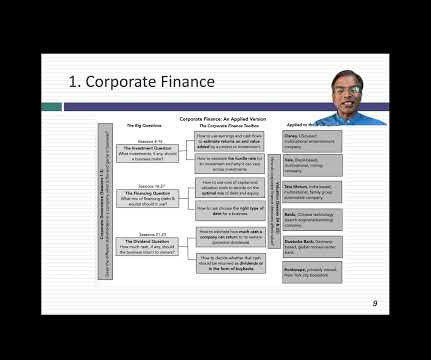

Data integration is key for any area of the enterprise, but data sharing between financial platforms is now one of the biggest focuses for enterprises and their financial service providers, particularly as open banking trends begin to simmer in the U.S.

Let's personalize your content