Evaluating Benchmark Misfit Risk

CFA Institute

DECEMBER 19, 2022

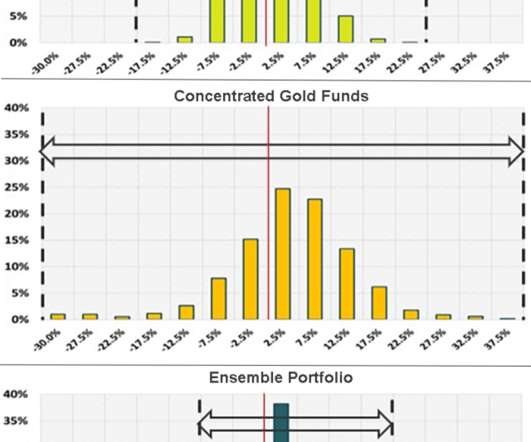

How can we identify and measure a portfolio's benchmark misfit risk?

CFA Institute

DECEMBER 19, 2022

How can we identify and measure a portfolio's benchmark misfit risk?

PYMNTS

NOVEMBER 2, 2020

Bloomberg customers will now be able to use the news site's terminal to look at Credit Benchmark 's credit risk data, which comes from risk views of the world's largest financial institutions, according to a press release. Clients will also be able to use the data for an enterprise use case, the release stated.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future CFO

FEBRUARY 27, 2024

It encompasses environmental, social, and economic dimensions and involves the responsible use of resources, reducing waste and pollution, promoting social equity, and ensuring economic viability over the long term,” she put forward. According to Soni, ESG factors are often integral to sustainability efforts.

CFO Leadership

OCTOBER 10, 2023

The latter, for example, is an offering that Bloomberg says can “ bring the full potential of AI to the financial domain ” and create entirely new workflows, economic analyses and financial benchmarks for its customers. That includes investing in people and business processes that can help your AI initiative be successful.

Spreadym

JUNE 8, 2023

Forecasts can be short-term or long-term and are usually based on assumptions about factors like market conditions, customer behavior, economic trends, and internal capabilities. They help organizations anticipate potential risks, identify opportunities, and make informed decisions about resource allocation and strategic planning.

Barry Ritholtz

OCTOBER 17, 2023

The transcript from this week’s MiB: Graeme Forster, Orbis Investments , is below. Barry Ritholtz] This week on the podcast, I have an extra special guest, Graham Foster’s pm at Orbis Investment Management. They have a truly unique approach to investing. Is that poker, is that investing sounds like both.

CFA Institute

JANUARY 31, 2019

What is Ensemble Active Management (EAM) and how can it help active managers outperform their benchmarks after fees?

Let's personalize your content