Planful vs. Vena

The Finance Weekly

MAY 29, 2024

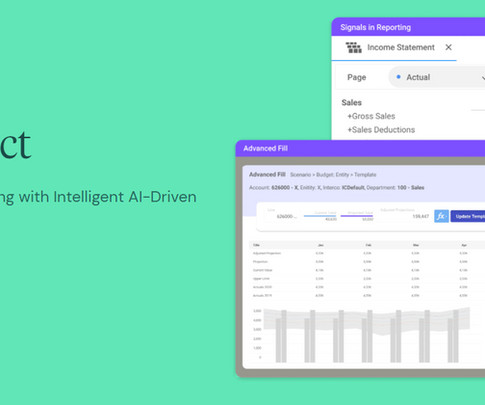

A study revealed that inefficiencies in the traditional FP&A role, like manual preparation of P&Ls, balance sheets, and cash flows, lead to an annual economic loss of $6.1 As the FP&A software industry explodes, more and more businesses are looking for tools to help them budget, forecast, and automate their data.

Let's personalize your content