Round Trip

Barry Ritholtz

AUGUST 1, 2023

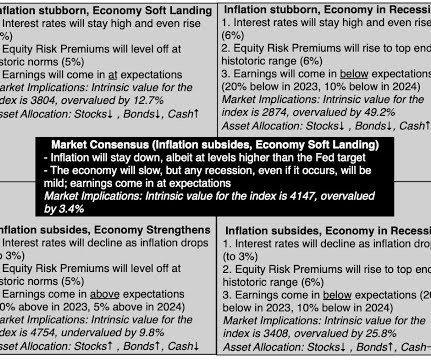

Forecasting Folly : Did you get sucked into the endless predictions of doom and gloom ? Recall John Kenneth Galbraith’s observation: “The only function of economic forecasting is to make astrology look respectable.” Never forget: Forecasts are marketing. Were you convinced by the people who saw the Recession coming ?

Let's personalize your content