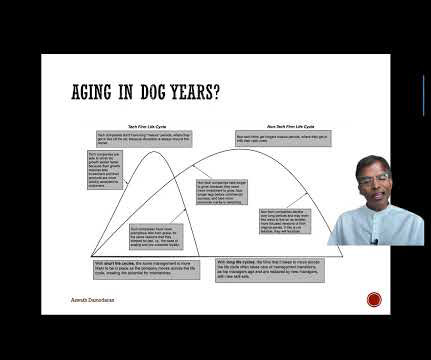

The Corporate Life Cycle: Corporate Finance, Valuation and Investing Implications!

Musings on Markets

AUGUST 19, 2024

In fact, the business life cycle has become an integral part of the corporate finance, valuation and investing classes that I teach, and in many of the posts that I have written on this blog. In conclusion It is the dream, in every discipline, to come up with a theory or construct that explains everything in that disciple.

Let's personalize your content