Musings on Markets: META Lesson 1: Corporate Governance

CFO News Room

NOVEMBER 5, 2022

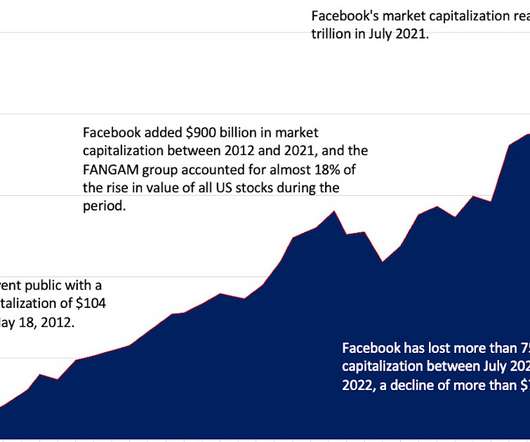

Investors, used to a decade of better-than-expected earnings and rising stock prices at these companies, have been blindsided by unexpected bad news in earnings reports, and have knocked down the market capitalization of these companies by hundreds of billions of dollars in the last few weeks.

Let's personalize your content