Turning Currency Volatility Into A Global FX Strategy

PYMNTS

JUNE 27, 2018

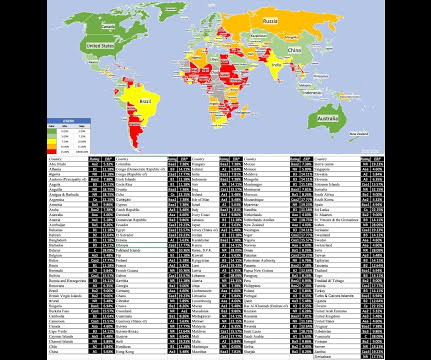

Yet, understanding and developing a clear strategy for FX risk mitigation can be elusive, even for the largest firms. Studies also show that most executives agree their top challenge is market volatility and the struggle to determine when — and how — to hedge currency risk.

Let's personalize your content