Top-down budgeting vs bottom-up budgeting: Which one is best for your business?

CFO Dive

OCTOBER 3, 2022

In this article, we'll go over both approaches to budgeting so you can pick the one that works best for your business.

CFO Dive

OCTOBER 3, 2022

In this article, we'll go over both approaches to budgeting so you can pick the one that works best for your business.

The Reformed Broker

OCTOBER 3, 2022

I’m going to tell you a quick story in the order in which it happened. You were there. You will be familiar with the sequence of these events. But you may not have reached the shocking conclusion that I have. At least not yet. Wait for it… Our story begins in 2019… It was the best of times, it was the best of times. The tail end of a decade of uninterrupted asset price appreciation for the top decile of.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Barry Ritholtz

OCTOBER 3, 2022

Click for audio. I sat down with Jon Luskin of Bogleheads to record episode #18: We focus on the cognitive & behavioral side of investing, as well as different ways of approaching risk. The post Bogleheads Live appeared first on The Big Picture.

The Reformed Broker

OCTOBER 3, 2022

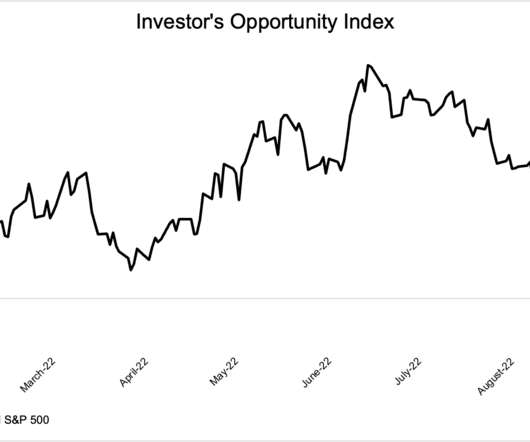

Every bear market has these two things in common: They end Expected returns go up The first thing is self-explanatory. The second thing should be obvious but from my talks with thousands of investors over the years, I have found that it is most certainly not intuitive to most people. When I tell you that expected returns are rising as stock prices fall, this is an overly simplistic way of saying that investors only get.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

CFA Institute

OCTOBER 3, 2022

The investment community needs to develop common standards to apply when conflicts like the Russia–Ukraine War break out.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Centage

OCTOBER 3, 2022

Excel is a popular spreadsheet tool for personal and business use. This accessible program can accomplish various tasks, such as financial forecasting and budgeting. Excel is an easy-to-use platform for inputting numbers and getting results with simple formulas. Businesses can also customize templates to suit their unique needs. If your business has used Excel for financial forecasting, you may have found some challenges with the program.

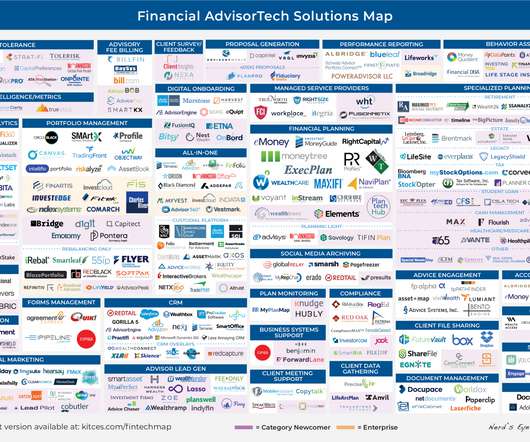

Nerd's Eye View

OCTOBER 3, 2022

Welcome to the October 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that DPL Financial Partners has raised $20M of capital to continue scaling up its marketplace of no-commission annuities for RIAs, as the ongoing development of new fee-based products – combined wit

https://trustedcfosolutions.com/feed/

OCTOBER 3, 2022

Many growing businesses have recognized and harnessed the benefits of outsourcing their accounting services. Rather than hiring full or part-time accountants or bookkeepers as permanent staff members, it often makes more sense to simply outsource —from both a monetary and scaling perspective. Unfortunately, the accounting field is experiencing a bit of a crisis, with nearly 75% of the CPA workforce having met retirement age in 2020.

Barry Ritholtz

OCTOBER 3, 2022

My back-to-work morning train WFH reads: • Ten handy phrases for bluffing your way through the new financial crisis : Those screams you hear are ten thousand self-appointed financial experts howling into the existential abyss. ( The Spectator ). • Cash Retakes Its Crown as the Fed Wrestles With Inflation : Investors are piling into products that shield them from losses in a rising rate environment. ( Businessweek ) see also Bonds May Be Having Their Worst Year Yet This has been the most devastat

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Centage

OCTOBER 3, 2022

Excel is a popular spreadsheet tool for personal and business use. This accessible program can accomplish various tasks, such as financial forecasting and budgeting. Excel is an easy-to-use platform for inputting numbers and getting results with simple formulas. Businesses can also customize templates to suit their unique needs. If your business has used Excel for financial forecasting, you may have found some challenges with the program.

Anaplan

OCTOBER 3, 2022

The buildup to Dreamforce 2022 was massive, and the event lived up to our highest expectations. With Anaplan’s headquarters in downtown San Francisco just steps away from the action, we […].

Strategic Treasurer

OCTOBER 3, 2022

Survey Results. Global Payments. The 2022 Global Payments survey offers a comprehensive evaluation of treasury-related payments functions regarding bank connectivity (including financial messaging formats and channels), cross-border and FX activity, security and fraud prevention, and the use of new payment technologies. Challenges associated with managing global payment complexity are examined, along with projected investment plans across various payment systems and services.

Future CFO

OCTOBER 3, 2022

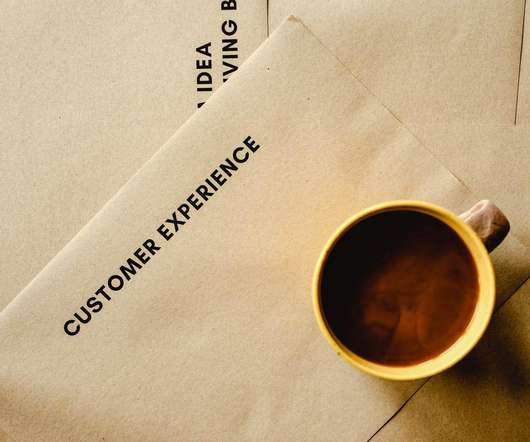

Customer experience has emerged as a key battleground and businesses that can win the customer experience war will be more likely to succeed in the long term. Today’s customers have been conditioned to expect outstanding experiences based on hyper-personalisation. To achieve this, organisations need access to accurate, real-time data and technology solutions that can help them maintain an excellent and consistent customer experience across various touchpoints.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Strategic Treasurer

OCTOBER 3, 2022

Episode 221. Interest Rates, Liquidity Plans, and the Midterm’s Effect on Treasury. On this episode of the Treasury Update Podcast, Jason Campbell talks with Craig Jeffery and Paul Galloway of Strategic Treasurer on some of the ways treasury will be affected by changing interest rates and political offices. They also discuss some considerations and leading practices to keep in mind when experiencing an economic hiccup.

Future CFO

OCTOBER 3, 2022

Moving to SAP S/4HANA can modernise your business and drive innovation. It’s cutting-edge technology takes your business well beyond traditional enterprise resource planning (ERP) and lets you compete more effectively. It does this by connecting relevant business units, integrating processes like supply chain and finance, and providing real-time data from a single source of truth.

Future CFO

OCTOBER 3, 2022

Two new IMA certificate programs are now available for finance professionals to learn sustainable business practices and diversity, equity, and inclusion (DE&I). Both new IMA certificate programs include a cumulative assessment where participants can earn a professional certificate and digital badge, the accountancy body said. “The certificate programs serve as a type of training for all professionals, specifically for senior leaders who need to get up to speed on both areas, and for future

Future CFO

OCTOBER 3, 2022

There are differences between a transactional mindset and a transformational mindset. EY executives shared what a transformational strategy entails and the major integration challenges when companies pursue transformational transaction. The post Can M&A in APAC trigger business transformation? appeared first on FutureCFO.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Let's personalize your content