Down rounds could be ‘lightning rod’ for CFO action

CFO Dive

JUNE 8, 2023

Despite their stigma, down rounds can help CFOs get the financial buffer they need to weather economic dips and set the company back on a course toward growth.

CFO Dive

JUNE 8, 2023

Despite their stigma, down rounds can help CFOs get the financial buffer they need to weather economic dips and set the company back on a course toward growth.

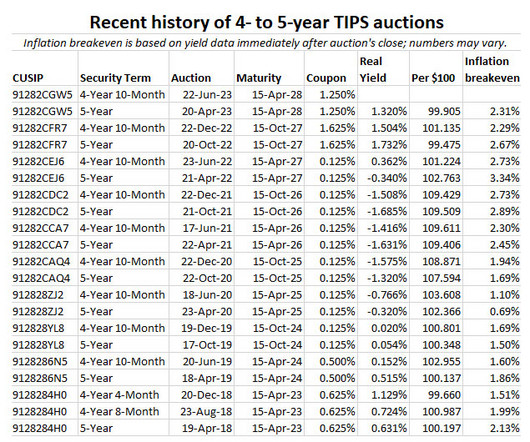

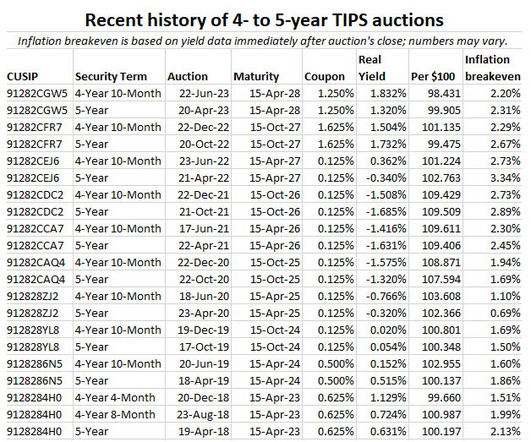

Tips Watch

JUNE 18, 2023

By David Enna, Tipswatch.com The U.S. Treasury on Thursday will offer $19 billion in a reopening auction of CUSIP 91282CGW5, creating a 4-year, 10-month Treasury Inflation-Protected Security.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

JUNE 15, 2023

Finance leaders are less willing to take on new risks and less optimistic about their companies’ financial prospects as their CEOs urge them to continue slashing costs.

Navigator SAP

JUNE 23, 2023

Technology advancements change the way business is performed. At first, they are used by market leaders to drive improved efficiency, then they are used by the rest of the business community to keep up with those market leaders. Examples of this tech advancement include the introduction of computers for business and the emergence of the internet.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

The Reformed Broker

JUNE 17, 2023

Please read this from Michael Santoli: Just as the depth of despond evident in investor-sentiment gauges around Labor Day was out of proportion to what the market and economy had been doing, the volume of cheer engendered by this four-week, 9% rally looks to be running at least a bit ahead of what has, after all, been a marginal upside exit from a long, grinding trading range.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Corporate Finance

JUNE 4, 2023

As we mentioned in the textbook, generally the shortest Treasury bills issued are 13 week maturity. However, given the recent debt ceiling problems, the Treasury issued cash management bills (CMBs), with a one day maturity. On Friday, June 2, the Treasury sold $15 billion in one day CMBs, to be issued on June 5 that mature on June 6. Over the past 25 years, the Treasury has held six CMBs auctions with a maturity of one day.

Tips Watch

JUNE 22, 2023

By David Enna, Tipswatch.com The Treasury just announced results of its $19 billion offering of a reopened 5-year TIPS, CUSIP 91282CGW5, and investors should be pleased. This 4-year, 10-month Treasury Inflation-Protected Security got an auctioned real yield of 1.

CFO Dive

JUNE 20, 2023

Employees who worked remotely before the pandemic continue to be 8% less productive than their peers who worked in the office before the onset of COVID-19, the New York Fed found in a case study.

Navigator SAP

JUNE 16, 2023

Many of the trends in business today come from the software industry. This is both because technology plays an increasingly important role in business, and because some of the most prominent businesses today are software-based. This has led to many software-industry concepts bleeding over into other lines of business. One of those concepts is project-based operations.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

The Reformed Broker

JUNE 11, 2023

The parabolic spike in 2-year Treasury bond rates this winter ended with a crescendo on Thursday, March 9th and Friday March 10th. That week, the collapse of Silicon Valley Bank had thoroughly spooked the markets and convinced traders that the Federal Reserve would be forced to start downshifting its hiking cycle and the accompanying hawkish rhetoric.

Barry Ritholtz

JUNE 3, 2023

This week, we speak with entrepreneur Ramit Sethi, who is the founder and chief executive officer of the online education platform I Will Teach You to Be Rich (IWT ), which attracts more than 1 million readers a month. Sethi is also the host of the Netflix series “ How To Get Rich ,” which is based on his New York Times bestselling book “ I Will Teach You to Be Rich “; he also hosts a podcast of the same name.

Global Finance

JUNE 25, 2023

Global Finance Magazine - Corporates are wielding M&A to scoop up the tech they need in order to keep up with strict rules and regulations.

CFO News

JUNE 13, 2023

Sudhir Soni says there is also a risk of something slipping through the cracks as in a joint audit responsibility gets divided and allocation of work may get missed.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

CFO Dive

JUNE 27, 2023

Businesses can no longer count on bad spelling and grammar to red-flag problem emails: Fraudsters are using AI to craft well-written email messages at scale.

Navigator SAP

JUNE 2, 2023

Professional services companies are dynamic businesses because they are built around people and rely on a roster of diverse clients that change over time and have evolving needs. Managing a professional services business can be tricky, especially as it grows beyond its founder and a handful of consultants. That’s why many professional services firms use an enterprise resource planning solution on the backend for management and visibility.

The Reformed Broker

JUNE 5, 2023

On this special episode of Live from The Compound, Scott Patterson, Financial Journalist and Wall Street Journal Reporter, joins Michael Batnick and Josh Brown to discuss Scott’s new book, Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis. Follow Scott on: Twitter Book. The post Black Swans, Stock Market Crashes and the Chaos Kings appeared first on The Reformed Broker.

Barry Ritholtz

JUNE 17, 2023

This week, we speak with Gretchen Morgenson, senior financial reporter for the NBC News investigative unit. A former stockbroker and alumna of the New York Times and Wall Street Journal, she won the Pulitzer Prize in 2002 for her “trenchant and incisive” reporting on finance. She (and coauthor Joshua Rosner) recently published “ These Are the Plunderers: How Private Equity Runs―and Wrecks―America.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Global Finance

JUNE 4, 2023

Morgan Stanley CEO James Gorman led the firm through a spate of acquisitions that greatly elevated its position in the wealth management sector and his successor may emerge from that part of the firm.

CFO News

JUNE 26, 2023

Auditors Diary: India’s audit watchdog on Monday issued a circular explaining the responsibilities of auditors in relation to reporting fraud in a company.

CFO Dive

JUNE 14, 2023

Wells Fargo CFO Michael P. Santomassimo is the latest big bank executive to detail commercial real estate distress and its potential impact on lenders.

Navigator SAP

JUNE 30, 2023

SAP recently made a significant change in how it develops, organizes, and releases new features. This change is good news for businesses that use SAP Business ByDesign because the change future-proofs the ByDesign solution and ultimately will enable businesses to take advantage of new SAP functionality more quickly. It also paves the way for more complete automation and artificial intelligence within the platform.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

The Reformed Broker

JUNE 1, 2023

RWM is coming to Austin, TX June 12th-14th @Downtown with more detailsEmail us at info@ritholtzwealth.com subject line “Austin” to reserve a meeting slot! pic.twitter.com/9iSdG4HFf3 — Ritholtz Wealth (@RitholtzWealth) May 19, 2023 I’m headed out to Austin, Texas this June and bringing a whole bunch of my Ritholtz Wealth Management colleagues with me, including our financial planner in the area.

Barry Ritholtz

JUNE 30, 2023

A quick note as the first half of 2023 draws to a close, shocking the locals with its intensity. Why? Because almost nobody saw this rally coming. 1 As of this moment, the indices stand appreciably higher than where they were on January 1, 2023: The NASDAQ 100 is up >38%, the S&P 500 is up ~15.5%, and the Russell 2000 small cap index is up almost 7%.

Global Finance

JUNE 9, 2023

Global Finance Magazine - Profit overrides principle with the recent PGA-LIV Golf& deal; expect more M&A in sports and other sectors.

CFO News

JUNE 30, 2023

Attra, was appointed to SBI as CFO on October 2020, had previously worked as a Partner at EY India and held a senior executive position at ICICI Securities. He was also a partner in SR Batliboi & Associates LLP and GM and chief Accountant in ICICI Bank.

Advertiser: GEP

“What should we do about the tariffs?” There’s no straightforward answer — every leader has a different expectation. CFOs want numbers. COOs want action. CEOs want strategy. And supply chain and procurement leaders need to be ready with the right response — fast. That’s why GEP has created a simple three-part framework that will help CPOs and CSCOs brief the board and C-suite with clarity and confidence.

Let's personalize your content