CFOs Draft New Game Plans

Global Finance

JUNE 4, 2023

Finance chiefs are making tough calls and learning new lessons in a stressful economic and credit landscape. But layoffs aren’t the only option.

Global Finance

JUNE 4, 2023

Finance chiefs are making tough calls and learning new lessons in a stressful economic and credit landscape. But layoffs aren’t the only option.

CFO Dive

JUNE 6, 2023

Digital investments tend to require a high level of collaboration due to their complexity and cross-functional nature, says Gartner analyst Emily Riley.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Spreadym

JUNE 8, 2023

Planning, budgeting and forecasting for a business are three distinct financial management tools used in business, each serving a different purpose. Key differences between planning, budgeting and forecasting for a business Here are key difference between planning, budgeting and forecasting for a business. Financial planning A plan is a strategic document that outlines the goals, objectives, and actions required to achieve a desired outcome.

CFO Selections

JUNE 7, 2023

A Chief Financial Officer (CFO) is a senior executive role that manages the financial actions of a company. The CFO's duties include tracking cash flow and financial planning as well as analyzing the company's financial strengths and weaknesses and proposing corrective actions. When a company asks CFO Selections to engage in a search for a CFO, we walk through each company’s specific needs to create a customized job description.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

The Finance Weekly

JUNE 7, 2023

It appears that summer is now in full force, and as the earnings season comes to a close, CFOs can finally find a moment to unwind. Nevertheless, before we embark on our beach retreat, we have some noteworthy updates regarding recent changes in CFO positions. CFO Pros on the Move May 2023 Valerie Lightfoot | Xwell Travel health and wellness services provider Xwell appointed , Valerie Lightfoot as CFO, effective June 12.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

The Reformed Broker

JUNE 5, 2023

On this special episode of Live from The Compound, Scott Patterson, Financial Journalist and Wall Street Journal Reporter, joins Michael Batnick and Josh Brown to discuss Scott’s new book, Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis. Follow Scott on: Twitter Book. The post Black Swans, Stock Market Crashes and the Chaos Kings appeared first on The Reformed Broker.

Navigator SAP

JUNE 6, 2023

Manufacturing ERP software (enterprise resource planning software) brings a plethora of advantages to organizations of all scales and sizes, from data protection to task automation and cost reduction. ERP systems offer advantages for data analytics and reporting, making them ideal for the manufacturing industry.

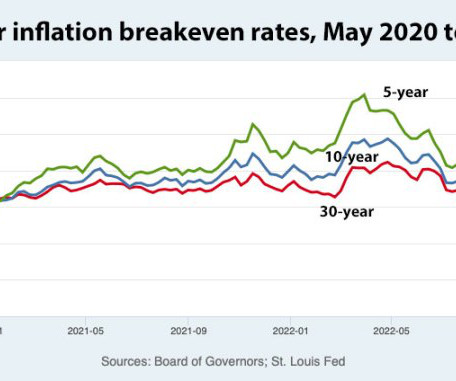

Tips Watch

JUNE 4, 2023

By David Enna, Tipswatch.com After weeks of financial gloom and omens of disaster, we finally had a “Goldilocks” week in the U.S. financial markets. For example: All is good, right?

CFO Dive

JUNE 5, 2023

As the path to the CFO seat branches off from the traditional accounting lane, questions about how to find — and train — the next generation of financial leaders are emerging.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Barry Ritholtz

JUNE 3, 2023

This week, we speak with entrepreneur Ramit Sethi, who is the founder and chief executive officer of the online education platform I Will Teach You to Be Rich (IWT ), which attracts more than 1 million readers a month. Sethi is also the host of the Netflix series “ How To Get Rich ,” which is based on his New York Times bestselling book “ I Will Teach You to Be Rich “; he also hosts a podcast of the same name.

Navigator SAP

JUNE 9, 2023

The life sciences are not like pens or bras. When a pen is manufactured incorrectly or suffers from shoddy inputs, a consumer just pulls out a different pen. When a life sciences product deviates from specs, be it a pharmaceutical or medical device, public health is affected and the defect might not even be readily observable. This reality is why life sciences companies are regulated by the Federal Drug Administration (FDA), and it is why they must follow good manufacturing practices (GMP) so th

Global Finance

JUNE 4, 2023

Morgan Stanley CEO James Gorman led the firm through a spate of acquisitions that greatly elevated its position in the wealth management sector and his successor may emerge from that part of the firm.

CFO Dive

JUNE 8, 2023

Despite their stigma, down rounds can help CFOs get the financial buffer they need to weather economic dips and set the company back on a course toward growth.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Barry Ritholtz

JUNE 5, 2023

My leaving-on-vacation , morning plane reads (see you in 10 days!): • There’s No Easy Exit for Companies Backed by PE and VC : Verdad Advisers’ Dan Rasmussen argues that rising debt costs, compressed margins, and negative cash flow make for a “pretty scary” picture of the health of private companies. ( Institutional Investor ) • Hedge Funds at War for Top Traders Dangle $120 Million Payouts : Paid sabbaticals, huge signing bonuses are among tools being used, as clients foot the bill in chase for

Navigator SAP

JUNE 8, 2023

Dedicated manufacturing enterprise resource planning (ERP) software is becoming increasingly essential for any manufacturing business’s success. There is also a growing need for ERP software to enable process automation effectively.

Global Finance

JUNE 9, 2023

Global Finance Magazine - Profit overrides principle with the recent PGA-LIV Golf& deal; expect more M&A in sports and other sectors.

CFO Dive

JUNE 6, 2023

The CFO swap comes days after Chemours announced it would funnel $592 million into a settlement fund aimed at resolving claims regarding hazardous “forever chemicals” contaminating U.S. water systems.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CFO News

JUNE 7, 2023

"Major listed companies opt for the top five auditors due to their strong reputation. The top auditors too prefer to work with the larger listed companies, especially in light of a few governance issues that came up in companies in the recent past as well as the regulatory actions taken against auditors," said Pranav Haldea, managing director, Prime Database Group.

Navigator SAP

JUNE 6, 2023

Scaling Business Growth with Cloud ERP Solutions: Expert Insights Listen to the podcast here: Nestell & Associates Website | Youtube | Apple Podcasts

Corporate Finance

JUNE 4, 2023

A recent article in the Wall Street Journal notes that as of May 26, 77 percent of the 485 companies in the S&P 500 that had reported earnings beat earnings, compared to the historical rate of 66 percent. What is even more surprising is that the earnings beats are 6.9 percent above expectations, compared to a 4.1 percent historical average. But accounting choices, which have been labeled as potential earnings manipulation, may be the cause.

CFO Dive

JUNE 6, 2023

Only 45% of respondents said their organization’s AI investments have led to a successful business impact, a Boston Consulting Group survey found.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

CFO News

JUNE 8, 2023

RBI’s growth projection for FY24 at 6.5% appears optimistic to economists. But the question that remains is what impact would meeting the inflation target have on the rate cut cycle? RBI’s pace of tightening monetary policy has slowed down but uncertainty remains on the future trajectory amid the global situation.

Navigator SAP

JUNE 4, 2023

More businesses and institutions are now embracing Enterprise Resource Planning (ERP) solutions with the aim of integrating and streamlining their workflows for improved productivity. These solutions have proved to be very useful to businesses, especially in the manufacturing sector, because they streamline the production process and ensure there’s consistency in your manufacturing activities.

Nerd's Eye View

JUNE 7, 2023

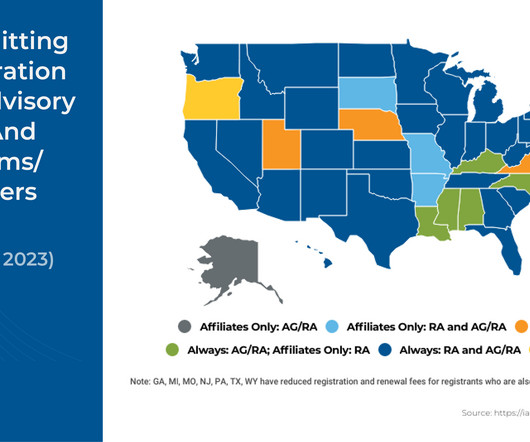

All Investment Adviser Representatives (IAR) of registered investment advisory firms are required to file Form U4, a regulatory filing containing public disclosures of certain information about financial professionals. And while IARs are responsible for keeping their own Form U4 up-to-date, Form U4 – unlike other regulatory forms like Form ADV that require an annual amendment – doesn’t need to be amended unless there is a change warranting an update, which can often lead to an

CFO Dive

JUNE 7, 2023

The need for consolidation, automation or better data is a top factor driving the spending increase, followed by a need to strengthen business value and a desire to generate growth amid macroeconomic pressures.

Advertiser: GEP

“What should we do about the tariffs?” There’s no straightforward answer — every leader has a different expectation. CFOs want numbers. COOs want action. CEOs want strategy. And supply chain and procurement leaders need to be ready with the right response — fast. That’s why GEP has created a simple three-part framework that will help CPOs and CSCOs brief the board and C-suite with clarity and confidence.

Let's personalize your content