Mastering the basics of annual budgeting

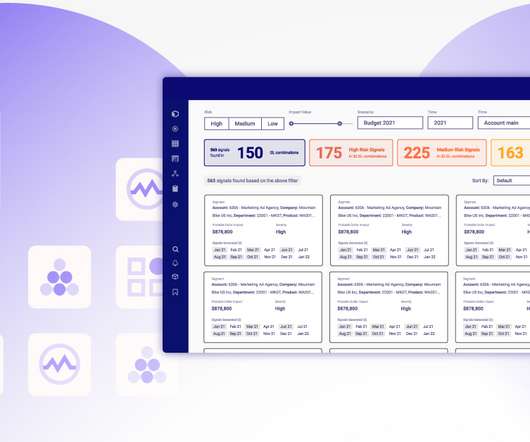

Anaplan

JUNE 11, 2021

Effective annual budgets aren’t just top-down initiatives to allot spending and set production targets. Done right, they can embody corporate priorities and spur growth.

Anaplan

JUNE 11, 2021

Effective annual budgets aren’t just top-down initiatives to allot spending and set production targets. Done right, they can embody corporate priorities and spur growth.

Corporate Finance

JUNE 11, 2021

Many of you are probably familiar with near instantaneous money transfers using Venmo or Paypal. And while we discussed next-day ACH transactions in the textbook, in 2017, an interbank payment system was unveiled, the real-time payment (RTP) network. While only 130 banks out of the more than 9,600 financial institutions in the U.S. have adopted the system, these adopting banks cover 60 percent of demand deposit checking and savings accounts.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future CFO

JUNE 11, 2021

One of the notable changes in the post-COVID-19 era is the growing popularity of Rolling Forecast. Now seen as an essential tool for FP&A, a rolling forecast has the potential to radically transform the traditional corporate budgeting process. When implemented properly, a Rolling Forecast expands your planning horizons, reduce your planning cycles, and help you to execute better organizational strategies.

CFA Institute

JUNE 11, 2021

A focus on intangible value creation can bring more financial discipline to ESG investments.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Anaplan

JUNE 9, 2021

Well-run sales operations enable the B2B sales organization to fulfill its mission: bringing home revenue. That means positioning sales within an overall revenue engine.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Future CFO

JUNE 10, 2021

The global economy is expected to expand 5.6% in 2021, the fastest post-recession pace in 80 years, largely on strong rebounds from a few major economies, World Bank said recently. . Despite the recovery, global output will be about 2% below pre-pandemic projections by the end of this year, the World Bank pointed out. Per capita income losses will not be unwound by 2022 for about two-thirds of emerging market and developing economies, the bank added.

CFA Institute

JUNE 10, 2021

Simon Witney provides a groundbreaking overview of effective governance and responsible investment in private equity.

Anaplan

JUNE 10, 2021

To increase revenue for your CPG products, first you need to identify its drivers, such as material costs and sales channels. We shine a light on the problem.

The CFO Centre

JUNE 10, 2021

Here’s another in our continuing series of ‘reasons for business owners to be cheerful’, based around a seminar session delivered to The FD Centre by respected UK behavioural economist Roger Martin-Fagg. Necessity. It’s the Mother of Invention, as we know. When the going gets tough, we all know how that phrase ends. But it is […]. The post Inventing our way out of the pandemic appeared first on CFO Center USA.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Planful

JUNE 9, 2021

Everyone talks about how much data they have available, but more and more, companies, and FP&A teams in particular, are struggling to make use of that data. In 2010, we collectively created 1.2 zettabytes (a trillion gigabytes) of new data. Eight years later, it ballooned to 33 zettabytes per year, and it’s expected to soar […]. The post For FP&A, AI’s Time Has Come appeared first on Planful.

CFA Institute

JUNE 9, 2021

What is the state of ESG analysis and how can investors both have an impact and invest with impact?

Musings on Markets

JUNE 9, 2021

For decades, the process that companies in the United States have used to go public has followed a familiar script. The company files a prospectus, providing prospective investors with information about its business model and financials, and hires an investment banker or bankers to manage the issuance process. The bankers, in addition to doing a roadshow where they market the company to investors, also price” the company for the offering, having tested out what investors are willing to pay, and

The CFO Centre

JUNE 10, 2021

The use of management dashboards to monitor management KPIs, metrics and other essential data points will allow you and your management team to make rapid, data-based decisions based on up-to-date information about your business. A management dashboard provides you with a comprehensive snapshot of the company’s performance. This is critical since it condenses massive amounts […].

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

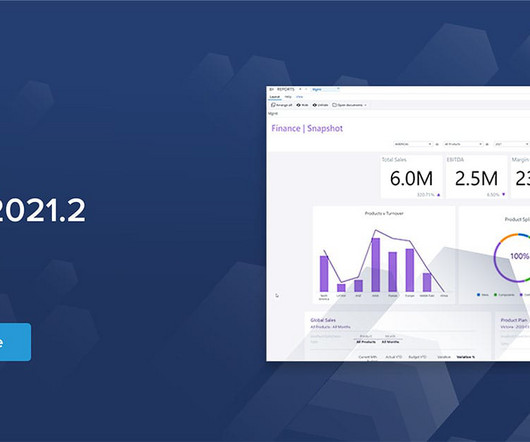

Jedox Finance

JUNE 8, 2021

With version 2021.2, the new Jedox Canvas is here and enables easy compilation of key information from different planning reports and analytics with drag and drop. See how it works here.

CFA Institute

JUNE 9, 2021

How should investors shift their fixed-income portfolios amid the US economic recovery?

Driven Insights

JUNE 5, 2021

Working remote, but not working alone.

The CFO Centre

JUNE 10, 2021

Your Guide to Business Financing Getting external financing to fund your company’s growth will depend on your plans, how willing you are to give away a stake, and, therefore, control in the business, your eligibility, and the short-term or long-term funding you need. How to finance your business growth Bank finance Banks can offer you: […]. The post External Funding Options for Your Growing Business appeared first on CFO Center USA.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Future CFO

JUNE 11, 2021

As organisations look for more agility and better visibility across all functions and revenue streams the traditional approach of using spreadsheets by the Financial Planning & Analysis (FP&A) team is nearing its limits. Extended Planning and Analysis (xP&A) processes will allow decision-makers to tap into enterprise data across sales, procurement, HR, marketing and other areas and functions to drive better decisions in faster timeframes.

CFA Institute

JUNE 7, 2021

“We’re still in the very early days of DeFi,” Mona El Isa says. “But this time is much more exciting. We’re seeing real usage and traction.".

Essentials of Corporate Finance

JUNE 11, 2021

Many of you are probably familiar with near instantaneous money transfers using Venmo or Paypal. And while we discussed next-day ACH transactions in the textbook, in 2017, an interbank payment system was unveiled, the real-time payment (RTP) network. While only 130 banks out of the more than 9,600 financial institutions in the U.S. have adopted the system, these adopting banks cover 60 percent of demand deposit checking and savings accounts.

The CFO Centre

JUNE 10, 2021

Plan Your Perfect Exit Strategy Selling your business to the right buyer for the right price at the right time depends on the health of your business, having the right advisors, and your timing. Get these factors right, and you can sell your business quickly. Before putting your business up for sale, you’ll need to […]. The post Checklist: How to Sell Your Business Fast appeared first on CFO Center USA.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Planful

JUNE 9, 2021

Everyone talks about how much data they have available, but more and more, companies, and FP&A teams in particular, are struggling to make use of that data. In 2010, we collectively created 1.2 zettabytes (a trillion gigabytes) of new data. Eight years later, it ballooned to 33 zettabytes per year , and it’s expected to soar past 175 zettabytes of new data generated annually by 2025.

CFA Institute

JUNE 6, 2021

When it comes to their benchmarking practices, US public pension funds need to find faster rabbits to chase.

Essentials of Corporate Finance

JUNE 10, 2021

During 2020, a record $270 billion in green bonds were issued, and green bond issuance is on pace to surpass that record this year. And while we discussed covenants and the ability of bondholders to undertake legal action against the bond issuer for violating these covenants, as a recent article in the Wall Street Journal highlights, green bond investors have little to no recourse if the bond issuer does not use the bond proceeds for green projects.

The CFO Centre

JUNE 10, 2021

Cash flow problems put your company at risk. Unless your company manages cash flow effectively and uses regular cash flow forecasts, your company is in jeopardy. Cash flow shortfalls mean: You can’t pay suppliers on time You can’t make debt repayments on time or at all You can’t buy new inventory to meet customer demand […]. The post Need Help with Your Cash Flow?

Advertiser: GEP

“What should we do about the tariffs?” There’s no straightforward answer — every leader has a different expectation. CFOs want numbers. COOs want action. CEOs want strategy. And supply chain and procurement leaders need to be ready with the right response — fast. That’s why GEP has created a simple three-part framework that will help CPOs and CSCOs brief the board and C-suite with clarity and confidence.

Let's personalize your content