The Number One Problem With Selling a Business

Focus CFO

DECEMBER 6, 2021

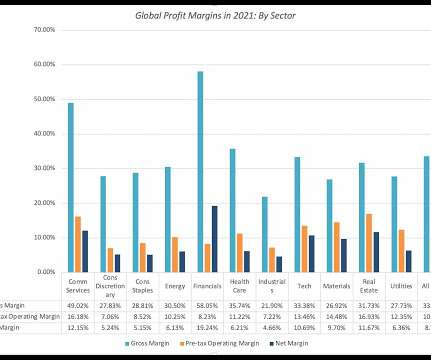

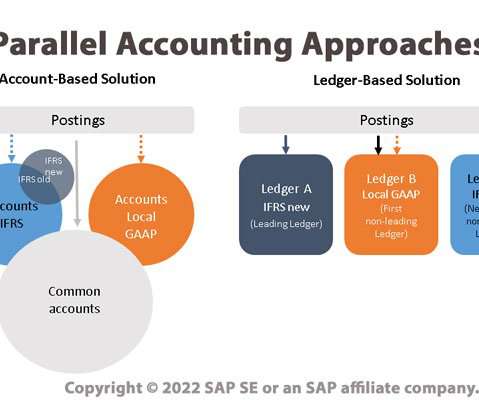

The Number One Problem With Selling a Business. GAAP financials when times get tough, and others manage to survive with street smarts. GAAP based Managerial Financial Statements. GAAP or IFRS based. GAAP or IFRS standards in order to maximize the value of the company. By Michael Stier. Download PDF.

Let's personalize your content