How to Properly Record Revenue for Nonprofits

The Charity CFO

DECEMBER 15, 2023

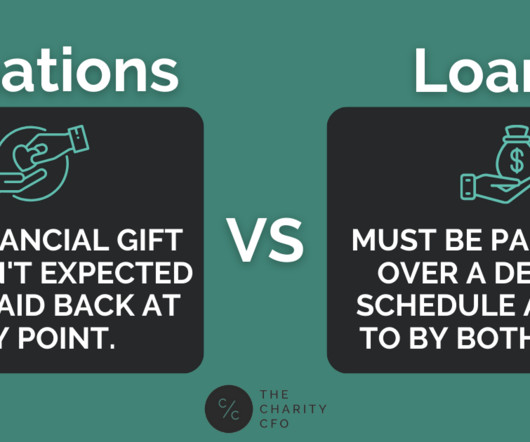

While the nature of a nonprofit means you’re focusing more on your mission than making money, bringing in revenue is still essential. This can lead to unique accounting and recordkeeping challenges that for-profit businesses don’t have to face—especially related to revenue classification.

Let's personalize your content