Data Update 7 for 2023: Dividends, Buybacks and Cash Flows

Musings on Markets

MARCH 8, 2023

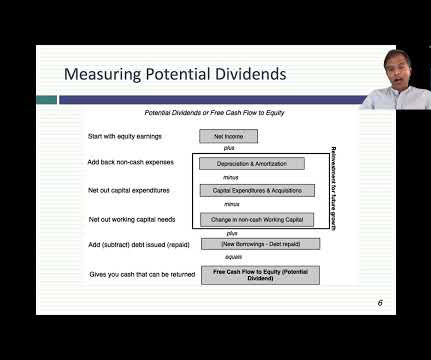

The dividend principle, which is the focus of this post is built on a very simple principle, which is that if a company is unable to find investments that make returns that meet its hurdle rate thresholds, it should return cash back to the owners in that business.

Let's personalize your content