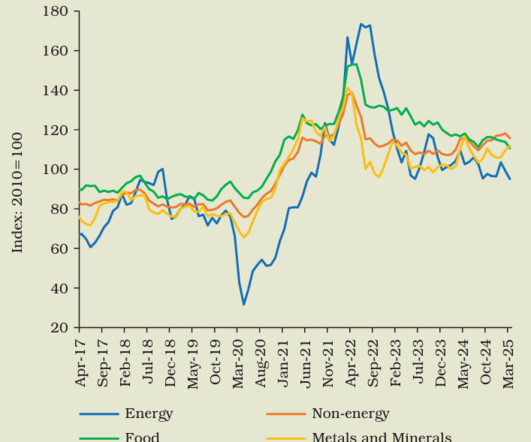

Everyone feels tariffs. It’s up to CFOs to manage the impact.

CFO Dive

JUNE 3, 2025

Understanding price elasticity at both the category and product level is now essential to effective pricing, an author and consultant who specializes on pricing writes.

Let's personalize your content