Financial Reporting Drives Good Decisions

CFO Simplified

APRIL 15, 2022

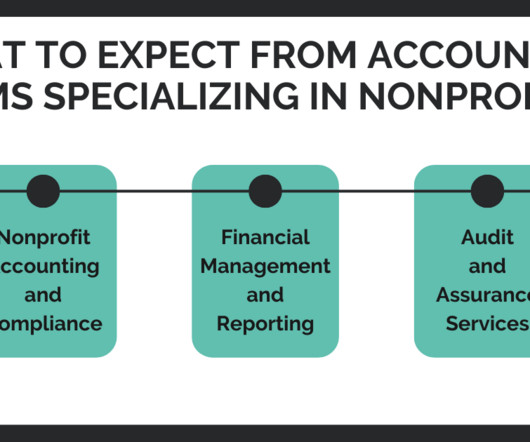

The company used Cash Basis accounting for their operating statements because taxes were calculated on a Cash Basis. When sales grew, profitability looked strong because cash came in within 48 hours, but the company’s bills weren’t due for 60 days. Accurate financial reporting is critical for any company.

Let's personalize your content