Private firms, not-for-profits reckon with CECL

CFO Dive

MARCH 18, 2024

Many not-for-profits and private companies are just beginning to grapple with the new rules for current expected credit loss accounting.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CFO Dive

MARCH 18, 2024

Many not-for-profits and private companies are just beginning to grapple with the new rules for current expected credit loss accounting.

The Charity CFO

APRIL 26, 2024

The right accountant can be the difference between an efficient accounting process and a total mess. That’s why it’s so important to know what to look for in a nonprofit accountant. The next step is to ask your potential nonprofit accountant a few questions to see if they’d be a good fit for your organization.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Capital CFO LLC

APRIL 4, 2023

As a business owner, you may have heard various accounting terms thrown around, such as balance sheet, cash flow, and profit and loss statement. However, it is essential to have […] The post Accounting Terms 101: A Beginners Guide for Business Owners appeared first on Capital CFO+.

CFO News

MAY 6, 2024

Several top executives of the three companies and auditors associated with some of them now face criminal charges due to the irregularities. Additionally, both auditors and their firms are undergoing disciplinary procedures.

CFO Share

APRIL 1, 2024

What to Expect When You Hire an Outsourced CFO The thought of hiring an outsourced Chief Financial Officer (CFO) has been on your mind, perhaps driven by stalled growth and advice from your mentors. Yet, hesitation shadows your resolve, fueled by fears of wasted money, loss of control, and dependency on a seemingly detached contractor.

The Charity CFO

DECEMBER 27, 2023

Does your nonprofit have ownership of a for-profit entity? Whether your organization owns a for-profit company outright or has limited ownership, a for-profit subsidiary can have serious tax implications for your nonprofit. Nonprofits with excess holdings may face an excise tax on the value of shares over the limit.

CFO Simplified

FEBRUARY 17, 2022

But understanding your company’s profitability is critical to making the right decisions. Bringing Value through CFO Insights. The business’ part-time CFO was providing financials that didn’t match the reports they received from their accountant. Change to accrual basis accounting. Sales – $45,000,000 annually.

The Charity CFO

OCTOBER 9, 2023

However, that’s not the case with an organization’s accounting systems. Let’s take a closer look at nonprofit accounting systems, the most frequent mistakes, and how to avoid trouble down the road. It’s vital to get these right from the beginning or risk serious consequences in the future.

CFO Share

NOVEMBER 18, 2023

To most small business owners, accounting best practices feel like an annoyance and distraction. However, common mistakes can create an accounting mess and impede growth. Solution : Accounting best practices require financials to close by the 15 th each month. If you do not know what that means, you are likely a culprit.

The Charity CFO

AUGUST 15, 2023

Myths of Nonprofit Accounting and Why They Matter to Job Seekers Unfortunately, many job seekers fall victim to the stereotypes and believe the myths surrounding nonprofit accounting. In this section, we will debunk the three most common nonprofit accounting myths. Ready to dive deep into this exciting realm?

Future CFO

OCTOBER 28, 2019

HSBC’s CFO Ewen Stevenson said the bank plans to restructure its loss-making businesses after announcing an 18% year-on-year drop in pre-tax profit in Q3 on Monday. The Hong Kong-listed bank reported pre-tax profit of US$4.8 The post HSBC CFO: Bank to restructure after Q3 profit drop appeared first on FutureCFO.

The SaaS CFO

APRIL 5, 2022

I talk about the SaaS P&L (profit and loss statement) almost every week with SaaS founders, finance, and accounting teams. The post How to Structure Your SaaS P&L appeared first on The SaaS CFO. At this point, I’ve reviewed hundreds of SaaS P&Ls (also called an income statement).

Future CFO

DECEMBER 5, 2022

While it is common to find a chief finance officer (CFO) helming a large or multinational organisation, the costs associated with having one in-house can be a hurdle for smaller organisations. According to payscale , the average base salary of a CFO in Hong Kong is HK$1,351,820 per year. Hiring a CFO when money is the problem.

The Charity CFO

JANUARY 13, 2022

But accounting for in-kind donations presents its own unique challenges. In this article, we’ll dig into how to account for in-kind donations on your nonprofit’s books. Why accounting for in-kind donations matters. Accounting for in-kind donations isn’t just important; it’s required for many nonprofit organizations. .

CFO Simplified

SEPTEMBER 11, 2022

There are two different ways of performing accounting functions in your business: One is on a cash basis, and the other is on an accrual basis. More often than not, your tax accountant is doing your taxes on a cash basis. Why should you use accrual basis accounting for your business? Cash Basis Accounting. Let’s dive in.

The Finance Weekly

MARCH 25, 2024

Big companies used to hog all the CFO action, but now even small and medium-sized businesses are jumping on the bandwagon. Why the sudden CFO craze? In a nutshell, companies are starting to view CFOs as smart investments rather than just expenses. Highest Paid CFOs in the World in 2024 1. AMRSQ) stock valued at over $8.

Michigan CFO

MAY 31, 2022

When it comes to making decisions that will affect your bottom line, it’s best to have the insight of a CFO to go by. But hiring a full-time CFO can be expensive. Enter part-time CFOs. A part-time CFO handles similar duties as a full-time CFO, but at reduced hours and hence reduced cost. What Is a Part-Time CFO?

CFO Simplified

MARCH 11, 2024

But what’s missing is the “home care” that’s needed to make sure that their firm is running efficiently and profitably. But as they grow, that admin is now doing their accounting without much more than a YouTube tutorial on QuickBooks. Their IOLTA account needs to be balanced and managed to the penny. Impressive – really.

CFO Thought Leader

APRIL 7, 2024

This episode features the FP&A insights and commentary of CFO Jeff Woolard or Velocity Global, CFO Aaron Alt of Cardinal Health and CFO Bob Houghton of Pivot Bio. Planful empowers finance, accounting, and business users to plan confidently, close faster, and report accurately.

Future CFO

DECEMBER 7, 2022

You want to do this because, for example, if you are suffering business losses or you feel that your competitor is doing something different or there is some new technology that you must keep up with. Foo suggests that it is the observation that finance is the last gatekeeper that lends to the perception that CFOs are risk-averse.

https://trustedcfosolutions.com/feed/

SEPTEMBER 15, 2022

As your business grows, your accounting solution should scale and grow with you, but this isn’t the case with older, outdated software. Expansion contributes to a profitable business, but if you don’t prepare to handle rapid growth, you will ultimately hurt your bottom line and prevent your business from reaping the benefits.

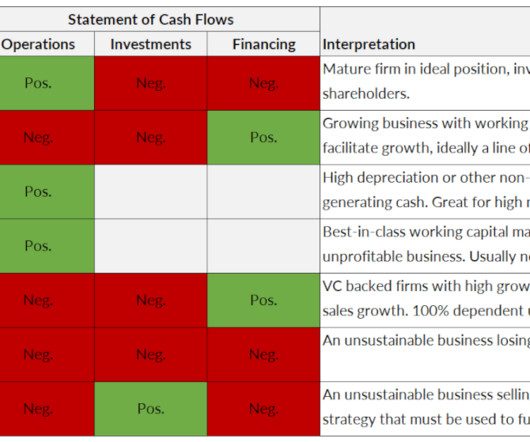

CFO Share

AUGUST 16, 2023

Here’s how they can be correlated in different scenarios: Mature Firm – Profitable P&L and positive cash flow The most sustainable situation and generally a favorable one as the company is generating profits on the income statement and generating positive cash flow from its operations. Hire our CFO services team today!

The Charity CFO

FEBRUARY 27, 2024

A budget and tracking system also help with transparency and accountability at all levels of your organization. At The Charity CFO, we like to do the latter because we feel it leaves you with a more realistic budget base. This is found in your accounting system and you’ll want to run a report based on the current year.

CFO Share

JULY 20, 2021

What does a Forensic Accountant Do? Is your small business not making as much profit as you expect? Are you earning profits but always falling short on cash? Since internal accountants are the most likely employee to be stealing from the company, businesses rely on forensic accounting consultants to investigate potential fraud.

CFO Simplified

DECEMBER 19, 2022

Often, I’m told by a business owner that they don’t understand why their financial statements show strong profitability for two or three months, and then — suddenly — they have a month with a significant loss. They have stable sales, but the highs and lows of profitability are confusing. You had a $6,000 loss.

The Charity CFO

JANUARY 31, 2022

You may also know it as a profit and loss statement or income and expense report. In the for-profit world, they call the difference between revenues and expenses net income. Or profit. . If you use cash-based accounting, you’ll only record cash deposited into your bank during the reporting period. .

PYMNTS

AUGUST 23, 2019

The Chicago-based company revealed that CFO Michael Randolfi, who has been with the company since 2016, is resigning, effective Friday (Aug. The CFO was more than just a CFO,” said Tom Forte, a senior research analyst at D.A. His departure from the company is a significant loss.”. Gross profit decreased to $292.1

Adam Kae

SEPTEMBER 24, 2020

Adam Kae & Associates is a Virtual Healthcare CFO. This article will talk about: What a CFO Does. What a Healthcare CFO Does. What it Means to be a Virtual CFO. CFO - Chief Financial Officer. CFOs are the head of the finance department. Here's a Brief List of (Some) CFO Tasks: Financial Reporting.

CFO Simplified

JANUARY 10, 2022

Look at these scenarios, and see if any sound familiar to you: An internet sales company showed financial reports with huge profits for three straight months, and then suddenly, huge losses during the next few. In spite of growing sales, they showed increasing losses as the year progressed. It’s that simple.

CFO News Room

NOVEMBER 7, 2022

billion to account for the deal. Berkshire Hathaway — Shares of Warren Buffett’s conglomerate rose more than 1% after the company posted a 20% increase in operating profits during the third quarter. billion loss on its investments during the third quarter’s market turmoil, however. health-care business to $14.5

Michigan CFO

SEPTEMBER 28, 2021

Each time we review a financial statement with our clients, they inevitably turn right to the Profit and Loss Statement (P&L, or Income Statement) and look to the “bottom line”. The business could have generated cash through profits, collection of accounts receivable, selling of assets (inventory) to name a few.

CFO Simplified

AUGUST 14, 2022

Watch Larry Chester, President of CFO Simplified and financial savant explain how to build back a good relationship with your bank so you can be bankable again in the video below. . You don’t want to be showing a large profit one month and a large loss the next month—even if over a period of time that balances itself out.

Future CFO

FEBRUARY 3, 2022

In a survey conducted by the Institute of Singapore Chartered Accountants (ISCA) , 89% of accountancy professionals indicated they have adapted to new ways of working and doing business — such as remote working, videoconferencing, and virtual collaboration — amid the pandemic, the accountancy body said recently.

The Charity CFO

SEPTEMBER 14, 2022

As a result, Congress implemented the UBIT in 1950 to eliminate the unfair advantage tax exemption gave to nonprofits competing against for-profit entities in the same sector. For example, the UBIT prevents an entity such as a church from using its exempt status to open a store purely for profit with no charitable purpose.

VCFO

OCTOBER 10, 2023

The owner of this seasonally oriented service company builds up cash in peak periods to get through slower months and has ~$1M sitting stagnantly in a bank account as a result. This owner focuses on maximizing profit and minimizing tax liability with reporting and operations directed at those aims. Request a Free Consultation Today.

The Charity CFO

MARCH 24, 2022

Fraud losses in the charitable industry destroy an organization’s reputation, future financing opportunities, and capacity to carry out its mission. The USDA relaxed the rules for those who can participate in the programs, allowing for-profit restaurants to join and allowing meals to be packaged and consumed off-site. .

CFO News Room

NOVEMBER 23, 2022

This provided great grounding, he says, particularly in financial accounting. He joined oil and gas company BG Group in their budgeting and forecasting team to broaden his management accounting and reporting experience. This meant everyone felt empowered to make the appropriate decisions to drive the company’s profitability”. “By

CFO Share

AUGUST 5, 2021

In simple terms, that means the cannabis industry taxable income is closer to its revenue rather than profit. The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. trimming shears).

CFO Simplified

JUNE 1, 2023

Most business owners get financial reports monthly: Profit and Loss, Balance Sheet, Statement of Cash Flows. How you use the information you get to go forward and drive profitability. How you use the information you get to go forward and drive profitability. More profitably. What IS your plan for profitability?

Future CFO

MARCH 19, 2024

To date, Toyota Finance has utilised the CCH Tagetik platform for three critical purposes: budgeting and planning, actual performance management, and lifecycle profit-and-loss management. The post Toyota Finance completes implementation of Wolter Kluwer's CPM solution appeared first on FutureCFO.

CFO Simplified

APRIL 15, 2022

The company used Cash Basis accounting for their operating statements because taxes were calculated on a Cash Basis. When sales grew, profitability looked strong because cash came in within 48 hours, but the company’s bills weren’t due for 60 days. The post Financial Reporting Drives Good Decisions appeared first on CFO Simplified.

CFO News Room

JANUARY 19, 2023

These protections help safeguard investors’ funds and securities in the event of a brokerage firm’s failure or other financial losses. In addition to this protection, Robinhood has implemented measures to monitor suspicious activity and protect users from financial loss due to fraudulent activity. Is Robinhood Safe to Use?

CFO Simplified

FEBRUARY 17, 2022

Bringing Value Through CFO Insights. The company was profitable, but after some moves to expand the business, they were worried about depleting their cash reserves and using up their line of credit with the bank—which would put a halt to further expansion plans. Create a GL account on the balance sheet for Customer Deposits.

Creative CFP

NOVEMBER 2, 2020

The cash flow statement is the final piece of the puzzle when it comes to the monthly management reports that we prepare here at Creative CFO. The cash flow statement in context The profit and loss statement, discussed in an earlier blog, provides information on the revenue and expenses over a certain period of time.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content