From Jo’burg to Jakarta: The CFO’s Passport to Global Control

CFO Talks

AUGUST 6, 2025

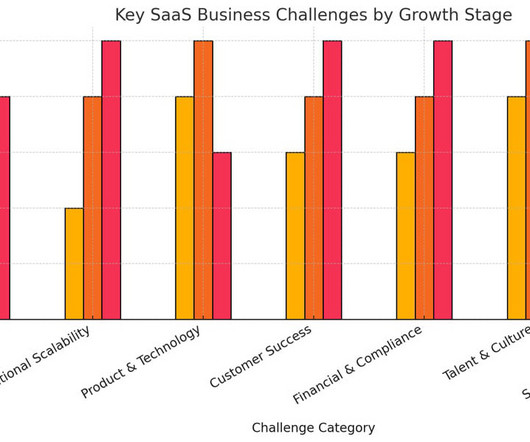

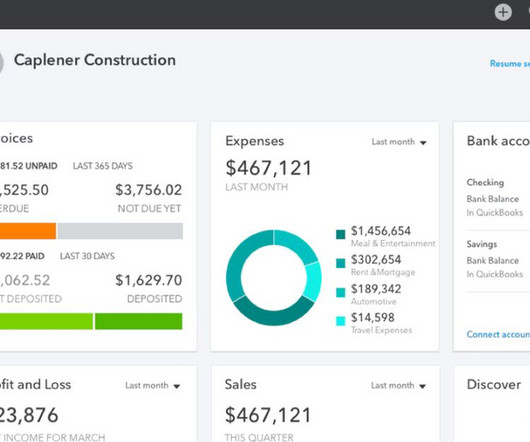

It’s about governance, compliance, control, cash flow, and risk, at scale. Are there statutory audit requirements? What are the filing deadlines, documentation standards, and audit tolerances? Cash Flow and Currency Risk Cash doesn’t move freely across all borders. Delays in compliance. IFRS, local GAAP)?

Let's personalize your content