Taking a strategic approach to AI adoption

Future CFO

FEBRUARY 14, 2025

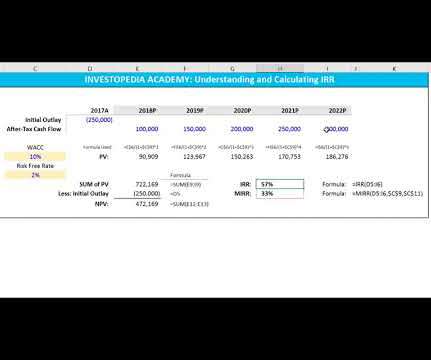

According to the Hitachi Vantara State of Data Infrastructure Survey, there are critical gaps that could undermine the regions AI momentum, despite ambitious investments. Understanding automation tools is also essential, as AI is reshaping processes such as financial planning, risk management, and audit compliance."

Let's personalize your content