PCAOB sanctions four audit firms in enforcement ‘sweep’

CFO Dive

OCTOBER 5, 2022

The watchdog for the firms that audit publicly-traded companies has intensified supervision in 2022, with plans to sharpen penalties against rule-breakers.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

OCTOBER 5, 2022

The watchdog for the firms that audit publicly-traded companies has intensified supervision in 2022, with plans to sharpen penalties against rule-breakers.

E78 Partners

NOVEMBER 12, 2024

Preparing for a financial audit can be a daunting task, especially for private equity-backed firms where accuracy and efficiency are paramount. This article provides a deeper look at the steps CFOs can take to create a seamless, streamlined audit experience.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Your Accounting Expertise Will Only Get You So Far: What Really Matters

E78 Partners

NOVEMBER 19, 2024

Audit season presents a set of unique challenges for private equity-backed companies, particularly those that must balance the expectations of investors with the demands of compliance. Ensure that impairment analyses are completed according to audit priorities, with asset groupings and forecast data that align with GAAP standards.

CFO Dive

OCTOBER 9, 2023

Jamie Miller departed from the Big Four firm just weeks following the failure of its plan to split its audit and consulting business into two distinct entities.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Forecasting That Works 📈 How AI and predictive analytics can improve financial planning. Compliance and Risk Considerations ✅ Navigating data-driven finance while staying audit-ready. Master the balance between analytics and action. Register now for exclusive insights!

CFO Dive

APRIL 12, 2023

Back in September, the Big Four accounting firm announced plans to split its auditing and consulting arms into two entities. Now, ‘Project Everest’ has been halted.

CFO Dive

APRIL 7, 2023

The federal tax collector plans to expand enforcement staff and reverse a decline in audit rates for businesses and households earning more than $400,000 per year.

CFO Dive

JULY 8, 2022

High inflation and tight labor markets have compelled many CFOs to revise business plans during the past several months. Most audit partners see the two challenges persisting.

Future CFO

DECEMBER 22, 2024

When planning your implementation, think beyond compliance. Strategies to Address This Challenge Conduct Data Audits : Regularly review your customer database to identify inaccuracies. Ensure Data Quality : Conduct regular data audits to support seamless integration.

Collectiv

MAY 19, 2025

But theyve been locked out of the planning process because traditional tools werent built for them. It puts forecasting capabilities in the hands of sales managers, budget owners, and department leadswithout requiring them to learn DAX or navigate a planning system built for analysts. They understand the drivers. The impact?

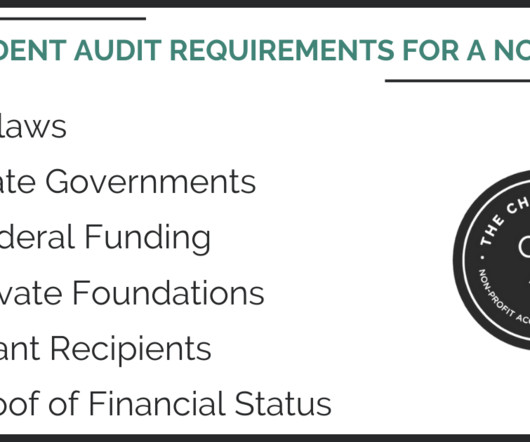

The Charity CFO

MARCH 31, 2023

The word audit can invoke instant fear and dread. Whether it’s an IRS audit, external audit, or even an internal audit, the process can feel burdensome and worrying. Contrary to popular belief, most audits are not conducted to detect a problem. Should My Nonprofit Obtain an Independent Audit?

CFO Strategic Partners

APRIL 15, 2025

A Year-Round Audit Strategy Is A Great Place To Start Insights from Acclarity Accredited to Small-to Medium Business Leader: Michele Himes For all but one day of the year, the end of your financial year is always approaching — sometimes year-end is still months away, other times year-end is right around the corner. Month-End Close.

CFO News Room

NOVEMBER 22, 2022

Newly released federal audits reveal widespread overcharges and other errors in payments to Medicare Advantage health plans for seniors, with some plans overbilling the government more than $1,000 per patient a year on average. Originally published at Kaiser Health News. But after nearly a decade, that has yet to happen.

CFO News

FEBRUARY 27, 2025

The NFRA plans to focus on auditing firms with significant listed company audits, using data analytics to detect potential issues. Chairman Ajay Bhushan Prasad Pandey emphasized the need for auditors' independence and professionalism. Upcoming inspections of firms like Deloitte and E&Y will assess improvements in processes.

CFO News

FEBRUARY 28, 2025

The NFRA plans to focus on auditing firms with significant listed company audits, using data analytics to detect potential issues. Chairman Ajay Bhushan Prasad Pandey emphasized the need for auditors' independence and professionalism. Upcoming inspections of firms like Deloitte and E&Y will assess improvements in processes.

Global Finance

MAY 3, 2023

EY, one of the “Big 4 Four” auditors, is postponing plans to split its auditing and consulting units. The firm’s global executive committee remains “committed to creating two world-class organizations that further advance audit quality, independence and client choice.” ” Codenamed.

CFO News

JANUARY 8, 2024

The regulator's plan comes after it released, late in December 2023, inspection reports on deficiencies in the audit processes of major firms such as BSR & Co, Deloitte Haskins & Sells, SR Batliboi & Co, Price Waterhouse Chartered Accountants LLP and Walker Chandiok & Co.

PYMNTS

SEPTEMBER 14, 2020

Deloitte will be the first of the “Big Four” auditors to break up its business after selecting a new auditing board to undertake the task, according to a report from The Telegraph. 11), Deloitte revealed it had set up an audit governance board to help to eventually separate the audit division from the rest of the company.

Global Finance

JUNE 13, 2025

There is more of an accountant, who comes from the audit function, which I think is more about compliance and implementing standards but has less business interaction. It was a role that was a combination of operational planning and financial planning. Bergmann: I have been in this role for 10 years at different companies.

Collectiv

JUNE 30, 2025

Instead of static reports or disconnected spreadsheets, organizations are now using Power BI as a two-way interface: one that not only reflects data from source systems, but also enables users to update, plan, and submit changes directly within the report experience. The result is a more collaborative, accurate, and timely planning process.

The Charity CFO

APRIL 1, 2025

Its not just about clean books or audit prep. This section focuses on: Approval workflows and disbursement controls Monthly reconciliations and reporting cycles Digital document retention Audit readiness and compliance planning These practices are essential to creating a trustworthy, funder-ready organization.

CFO News

JUNE 13, 2023

Carmine Di Sibio, who has headed the group since 2019, was supposed to oversee the break-up until the end of his mandate in 2025 but the project was rejected by its US branch in April.

CFO Talks

NOVEMBER 29, 2024

This opportunity allowed me to audit clients like the South African Revenue Service and South African Tourism, as well as manage accounts for Mastercard South Africa. I was particularly impressed with how organised and meticulous the Chinese are in their planning and how they receive their guests.

CFO Dive

JUNE 23, 2025

“They are focusing on driving growth and efficiency to help their companies move faster, benefiting both top line revenue and operational performance,” says Tarek Ebeid, KPMG Private Leader and Partner in Charge – Audit Practice at KPMG US.

CFO Talks

JUNE 3, 2025

This model resembles Unilevers finance transformation where predictive analytics freed up 30 percent of finance teams time for scenario planning and business partnering. The United Kingdoms National Audit Office has advised public entities to adopt rolling forecasts and scenario-based planning, particularly in uncertain environments.

Future CFO

FEBRUARY 14, 2025

Addressing such gaps is crucial for the organisation, including the Finance function, as it can impact cost planning and decision-making processes. The ability to integrate AI into financial planning also means we are seeing improved efficiency, allowing Finance teams to focus on strategic initiatives rather than administrative tasks."

CFO Strategic Partners

MARCH 28, 2025

These services include general and operational accounting, financial planning and audit, governance, risk and compliance, transactional transformation, IT and business intelligence solutions, and outsourced accounting and interim management solutions. Latest insights Leadership 05.29.25

CFO Plans

APRIL 14, 2025

Consider conducting a thorough financial audit to pinpoint areas for improvement. Creating a Tax Compliance Recovery Plan A comprehensive tax compliance recovery plan is indispensable. This plan should encompass regular training for your financial team on the latest tax regulations and compliance requirements.

The Charity CFO

DECEMBER 18, 2024

Organizations that expend over $750,000 in federal funds (increasing to $1 million in 2025) are subject to a single audit. This audit goes beyond typical financial audits and examines programmatic compliance as well. Program Flexibility Federal funding can limit an organization’s ability to adapt its programs.

E78 Partners

NOVEMBER 12, 2024

Preparing for a financial audit can be a daunting task, especially for private equity-backed firms where accuracy and efficiency are paramount. This article provides a deeper look at the steps CFOs can take to create a seamless, streamlined audit experience.

E78 Partners

NOVEMBER 12, 2024

Preparing for a financial audit can be a daunting task, especially for private equity-backed firms where accuracy and efficiency are paramount. This article provides a deeper look at the steps CFOs can take to create a seamless, streamlined audit experience.

E78 Partners

JANUARY 5, 2024

Audits are an essential part of ensuring that a company’s financial statements are accurate and compliant with accounting standards. Proper preparation is critical in navigating the post-acquisition audit process smoothly, minimizing disruptions, and providing timely, accurate information to stakeholders.

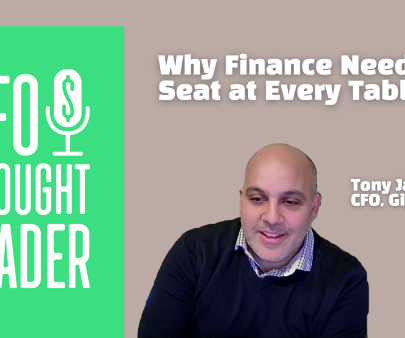

CFO Thought Leader

APRIL 9, 2025

Tony Jarjoura, now CFO of Gigamon, found himself surrounded by audit committee members as a dense, highly technical tax strategy unraveled before them. CFOTL: From your early assessment, what challenges and opportunities do you see in Gigamons financial structureand how do you plan to address or leverage them?

Future CFO

MAY 11, 2025

Editors note: In todays A Day in the Life , Nguyn Trung Ngn (pictured), tax senior manager at Deloitte Vietnam , shares with FutureCFO audiences how leading a complex transfer pricing audit for a multinational client became pivotal for her career and how her passion for public writing became one of her greatest sources of inspiration.

E78 Partners

DECEMBER 5, 2024

Without careful planning, organizations may face trade-offs, reallocating funds from other critical IT initiatives to accommodate AI investments. Learn more about our Inventory Assessment and Historical Audit here. While this method provides flexibility, it can significantly disrupt existing cost structures and projections.

Future CFO

NOVEMBER 20, 2022

Cyberthreats and IT governance are among the top concerns of auditors in 2023, said Gartner recently when releasing the Gartner 2023 Audit Plan Hot Spots Report. The post What are top concerns of auditors in 2023? appeared first on FutureCFO.

Future CFO

APRIL 4, 2024

In a recent joint survey by the Association of Chartered Certified Accountants and the Chartered Accountants Australia and New Zealand , it was revealed that both current audit professionals and prospective entrants stress the crucial need to achieve equilibrium between work and one’s personal life.

CFO News

MARCH 13, 2025

Sebi expands the scope of Unpublished Price Sensitive Information (UPSI) to include proposed fundraising activities, restructuring plans, and one-time bank settlements. New rules categorize various activities, including fraud or defaults, forensic audits, and regulatory actions, under UPSI to minimize litigation and appeals.

E78 Partners

NOVEMBER 19, 2024

Audit season presents a set of unique challenges for private equity-backed companies, particularly those that must balance the expectations of investors with the demands of compliance. Ensure that impairment analyses are completed according to audit priorities, with asset groupings and forecast data that align with GAAP standards.

E78 Partners

NOVEMBER 19, 2024

Audit season presents a set of unique challenges for private equity-backed companies, particularly those that must balance the expectations of investors with the demands of compliance. Ensure that impairment analyses are completed according to audit priorities, with asset groupings and forecast data that align with GAAP standards.

The Charity CFO

MAY 12, 2025

Theyre the people who spot errors in a sea of numbers and ensure the books are airtight and audit-ready. Its important to understand that this role requires a unique mindset: someone detail-oriented, systems-focused, and organized to the core. When the structure isnt there, the stress compounds and chaos creeps in.

Nerd's Eye View

JANUARY 27, 2025

Tools are available to help ensure that communications are securely archived and include necessary disclosures to meet regulatory requirements, promoting transparency and ensuring that firms are prepared for audits.

CFO Talks

NOVEMBER 12, 2024

Maintaining clear boundaries and strategic planning are essential to my approach. I make it a priority to plan the majority of my month in advance, which enables me to balance my professional and personal commitments effectively. Can you share some career highlights and defining moments?

CFO Talks

NOVEMBER 6, 2024

In markets businesses face a mix of global influences, currency shifts, and regional economic trends that can impact everything from cash flow to expansion plans. Watching these signals lets you spot trends early and plan proactive responses. Build Scenarios, Not Just Budgets Traditional budgeting has its limits when the market shifts.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content