European Banks Pursue Mergers To Gain Competitive Edge

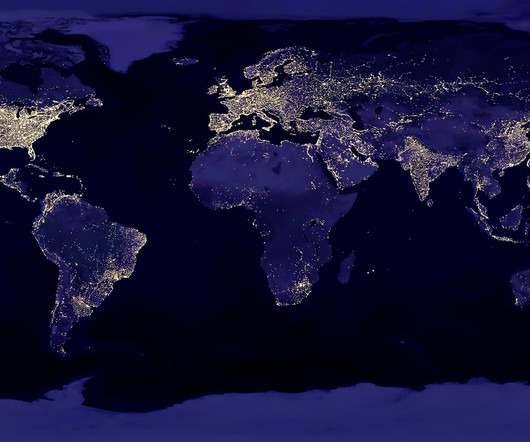

Global Finance

FEBRUARY 14, 2025

Lenders across Europe are ramping up M&A efforts to scale operations, strengthen balance sheets, and navigate an evolving financial landscape. The European banking sector is experiencing a wave of consolidation as institutions seek to bolster their market position, expand their asset base, and improve returns. that gathered $5.4

Let's personalize your content