Autonomous finance will arrive within three years: Ramp CEO

CFO Dive

AUGUST 5, 2025

You can unsubscribe at anytime. Sign up A valid email address is required. Please select at least one newsletter.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

AUGUST 5, 2025

You can unsubscribe at anytime. Sign up A valid email address is required. Please select at least one newsletter.

Future CFO

DECEMBER 4, 2024

This requires expertise beyond finance, including knowledge of the global economy, market trends, laws and regulations, business strategy, and emerging technologies.” Wong admits that he has always enjoyed pushing boundaries and setting new benchmarks for himself and his team.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

CFO Plans

DECEMBER 2, 2024

By scrutinizing financial statements and operational data, you gain insights into cost structures, pricing strategies, and market positioning. Data-Driven Growth Strategies for Hotels For hotels, growth strategies must be data-driven and aligned with market trends.

AI In Accounting: A Practical Roadmap For Smarter AP

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Barry Ritholtz

DECEMBER 11, 2024

Fitness alpha is a model of performance, and we can derive alpha in markets from so many different areas. So if our benchmark is the S& P 500, we’re a money manager, and we make 25 percent in a year when the market’s up 20%. If the market’s up 20%. So the markets are stressful.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

Economics and Returns 📈 Adapt to shifting market conditions with flexible, cost-effective technology and operating models to consistently achieve desired economic benchmarks and returns. faster than their competitors. Learn how to offer the experiences and products that appeal to Gen Z.

Future CFO

NOVEMBER 6, 2024

CFOs and the Finance team rode on the waves of these shifts in the market, putting talent management—re-skilling and up-skilling—on the priorities list to help finance professionals through transformation and change.

Future CFO

JUNE 10, 2025

A number of well-followed ESG-themed stock indices have been outperforming their conventional benchmarks since 2022, presenting potentially attractive investment opportunities in Southeast Asia.

Barry Ritholtz

APRIL 17, 2025

If only there were some ways to prevent investors from interfering with the markets greatest strength the incomparable and guaranteed ability to create wealth by compounding over time. Drawdowns, corrections, and crashes are not the problem your behavior in response to market turmoil is what causes long-term financial harm.

CFO Talks

AUGUST 12, 2025

In a South African context, where companies often navigate complex regulatory environments, volatile market conditions, and diverse stakeholder expectations, this kind of insight is not a luxury. Benchmark against competitors. It speeds up execution because you already know the right people to involve. It is a strategic advantage.

Musings on Markets

JULY 31, 2025

If you are leery about trusting ratings agencies, I understand your distrust, and there is an alternative measure of sovereign default risk, at least for about half of all countries, and that is the sovereign credit default swap (CDS) market, which investors can buy protection against country default.

Global Finance

JULY 30, 2025

As milestones go, being at the forefront of a country’s banking sector for 50 years, and driving economic growth and championing customer-centric innovation, is something to celebrate. Further, ever since CIB embraced the digital revolution around the mid- to late-1990s, it has set new benchmarks to offer advanced banking solutions.

CFO Talks

MARCH 28, 2025

CFOs today are expected to: Align economic performance with environmental and social responsibility. Case in Point: A mid-sized logistics firm in Morocco used the BIPP to benchmark its financial resilience and non-financial reporting practices. Finance is more than an economic toolits a powerful lever to transform societies.

CFO Dive

AUGUST 11, 2025

Spencer Platt / Staff via Getty Images Dive Brief: Six out of 10 corporate economists predict that the Federal Reserve will trim borrowing costs by a quarter percentage point next month as the labor market softens and tariffs give just a one-time jolt to inflation, Wolters Kluwer said Monday. in the third quarter and 3.4%

Musings on Markets

JUNE 17, 2025

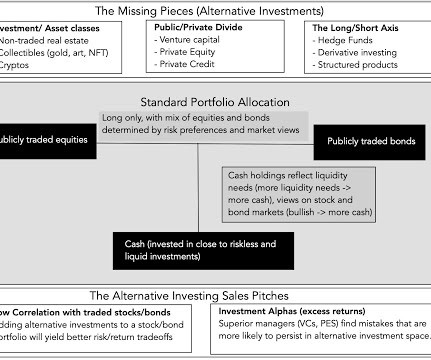

These ignored investment classes are what fall under the rubric of alternative investments, and while many of these choices have been with us for as long as we have had financial markets, they were accessible to only a small subset of investors for much of that period.

E78 Partners

JUNE 12, 2025

In today’s market, private equity firms recognize that acquisition alone no longer drives sufficient growth. In today’s competitive and high-cost market, sponsors rely on margin expansion to drive higher valuations and prepare portfolio companies for exit. In 2025, top-performing firms go beyond sourcing deals. They optimize them.

The Big Picture

JULY 1, 2025

Bachelor’s in economics and a BS in computer science from Wellesley in Boston and then an MBA from Harvard Business School. So it was Pascal then c plus plus, and then I took an economics class and that’s when the lights went off because it was a very mathematical field in many ways, but also with a link to the Rio economy.

Trade Credit & Liquidity Management

JUNE 12, 2025

In an economic landscape marked by ongoing uncertainty, small businesses continue to navigate shifting consumer behaviors and market dynamics with remarkable adaptability. despite ongoing economic uncertainty. This underscores the importance of agility and local market knowledge for small business success.

Barry Ritholtz

MAY 1, 2025

These days, turning on the TV to get the latest news about the markets and the economy can be enough to send anyone into panic mode. The second section of your book focuses on Bad Numbers, or in other words, misleading numbers that could drive the economy, the markets and ultimately, your investments. How useful is management guidance?

Future CFO

AUGUST 10, 2025

CFOs, once focused primarily on risk mitigation and cost control, are now central architects of growth strategy—empowered by technologies that automate complexity and unlock new markets. In a region where cross-border trade is the lifeblood of economic activity, the inefficiencies of traditional settlement systems have long been a bottleneck.

Global Finance

FEBRUARY 4, 2025

By providing immediate cash flow, SCF helps suppliers avoid the pitfalls of traditional loans that can be challenging to secure during economic downturns. It also boosts adaptability and maintains stability in challenging markets. Additionally, SCF makes cash flow more predictable, aiding in better emergency planning.

Global Finance

MARCH 18, 2025

Supporting that is the capital of our ownersthe regulatory and economic capital to make sure there is a strong financial base to support those yen liabilities. Weve seen the market respond to tariffs with lower yields. The market is telling us its more concerned about a slowing economy than they are about inflation coming from tariffs.

CFO Talks

JANUARY 30, 2025

Whether its breaking into new markets, attaining cash flow positivity, or preparing for an exit strategy, the vision must be clear and measurable. Navigating Unexpected Challenges When unexpected challenges arise, such as market shifts or economic crises, Rogers approach is to stay agile and maintain transparency with stakeholders.

The Big Picture

JUNE 23, 2025

There are a few people in the world of fixed income that understands the bond market, the ETF market, what the fed’s doing, what is driving both institutional and household investors on the fixed income side. So the market is kind of sorta almost efficient, is, I don’t know how else to describe it. I’m assu.

CFO Strategic Partners

APRIL 14, 2025

Ultimately, lack of financial know-how can leave you unprepared for shifting economic conditions that could undermine revenue and growth. EBITDA measures operational earnings (not capital investments), and it is often a better profitability benchmark than net income.

Barry Ritholtz

APRIL 29, 2025

You get a bachelor’s in economics from Colgate and then an MBA in finance from NYU Stern. I was an economics and English major. I get the, the idea that, hey, this was kind of the early days of a bear market that that went on for another decade. So let’s start with your background. I was a liberal arts major.

Barry Ritholtz

FEBRUARY 17, 2025

Christine Philpots of Aerial Investments has specialized in emerging markets and frontier markets. She’s a boots on the ground type of investor who focuses and specializes in emerging market value. What makes that style of investing so interesting and different is simply market inefficiencies. Christine Philpots.

The Big Picture

AUGUST 13, 2025

Barry Ritholtz : Wall Street relies on data: Economic releases, quarterly earnings performance comparisons, but it’s really easy to get tripped up by all of this math. Obviously, BLS and BEA and Fred have a very long track record, but what factors do you consider when you’re looking at a source of economic data?

CFO Dive

JUNE 16, 2025

growth this year as inflation persists above the Federal Reserve’s 2% target, the National Association for Business Economics said Monday, citing a survey of forecasters. growth this year as inflation persists above the Federal Reserve’s 2% target, the National Association for Business Economics said Monday, citing a survey of forecasters.

Barry Ritholtz

MAY 6, 2025

That experience those two things combined to really create a kind of unique perspective on the world of markets, on the world of risk, and on the world of models. And it helped him emotionally to trade better because he realized that mother markets was gonna be right. Sander Gerber : Exactly. That was a hot period in option trading.

CFO Strategic Partners

MAY 29, 2025

Why CFOs Must Act Now: Turning Tariff Disruption into Strategic Opportunity Insights from Acclarity Accredited to FP&A Subject Matter Expert: Marcus Fisher Global markets are entering a period of structural disruption—and finance leaders are on the front lines.

CFO Dive

JULY 18, 2025

Dive Insight: Recent stability in consumer sentiment coincides with mixed economic signals, along with widening opinions among Federal Reserve officials on the outlook for jobs and inflation, and whether to cut borrowing costs as soon as this month. Retail sales rose 0.6% in June after a two-month slump.

Global Finance

JUNE 16, 2025

The main objectives for the IPO are to expand the fleet and network, including the lucrative Hajj and Umrah religious travel market, and to become fully digitalized while escalating its cargo operations. The Riyadh-based firm has an established route map that extends to Brussels, Casablanca and Mumbai. billion (about SAR7.6 billion). .

CFO Dive

AUGUST 4, 2025

You can unsubscribe at anytime. Sign up A valid email address is required. Please select at least one newsletter. With the Trump administration embracing digital assets, finance leaders need to get educated on the potential risk and reward of cryptocurrencies and stablecoins.

CFO Dive

AUGUST 6, 2025

Companies approach spending more cautiously amid economic uncertainty and geopolitical risks, Gartner said. Competitiveness is a primary reason why enterprises will invest in technology and business change despite an “eroding environment,” it said. You can unsubscribe at anytime. Sign up A valid email address is required.

Embark With Us

MARCH 26, 2025

The Competitiveness Compass was designed to set strategic priorities and guide the EU’s policy agenda over the next five years with a focus on boosting the region’s long-term competitiveness in the face of increasing global economic pressures.

CFO Dive

AUGUST 6, 2025

By failing to disclose such risks, the three defendants participated in a scheme to “deceive the investing public” and “artificially inflate and maintain the market price of Tesla securities. “As a result, the Company’s public statements were materially false and misleading at all relevant times.” You can unsubscribe at anytime.

The Big Picture

AUGUST 11, 2025

Barry Ritholtz : , I have a friend Noah Smith, who is physics and economics, like a killer double major. 00:23:47 [Speaker Changed] It, it’s amazing that everything you’re saying is so applicable to public markets investing. And there were things I did for marketing and PR and so on to help catalyze that.

CFO Dive

AUGUST 5, 2025

“The clear deterioration in the labor market and drag on real incomes from tariffs suggest a marked recovery is unlikely,” Oliver Allen, senior U.S. Along with the cooling labor market, inflation exceeding the Federal Reserve’s 2% long-run goal is also discouraging consumers from spending. in June to 107.55

The Big Picture

JULY 17, 2025

My morning train WFH reads: • Shake the Valuation Fixation : Whatever their level and whichever flavor you prefer, price-to-earnings ratios say little about markets’ future direction. to 1 percentage points lower than in a benchmark simulation using the Congressional Budget Office’s immigration projections through November 2024.

CFO News Room

FEBRUARY 5, 2022

The equity market witnessed some wild swings on the Budget Day, with the Sensex rebounding after losing more-than 2% from the day’s high. But unlike other Budget Days, benchmarks ended the day in the green, as investors cheered a growth-oriented Budget. By Yoosef Kp & Ruchit Purohit. After surging as much as 1,018.03

CFO News Room

FEBRUARY 2, 2022

The government and the central bank can deal with the movement of bond yield “in an orderly” and non-disruptive manner, economic affairs secretary Ajay Seth told FE on Wednesday. He sought to allay concerns over a potential spike in yield in the wake of a larger-than-expected market borrowing of Rs 14.95 lakh crore for this fiscal.

CFO News Room

FEBRUARY 4, 2023

The labor market is off to a strong start this year with 517,000 jobs added in January, an unemployment rate at a historic low of 3.4%, and wage growth that continues to decelerate, slowing down to 3.7% After benchmarking against UI records, total payroll employment for March 2022 was revised up by 568k jobs.

CFO News Room

DECEMBER 7, 2022

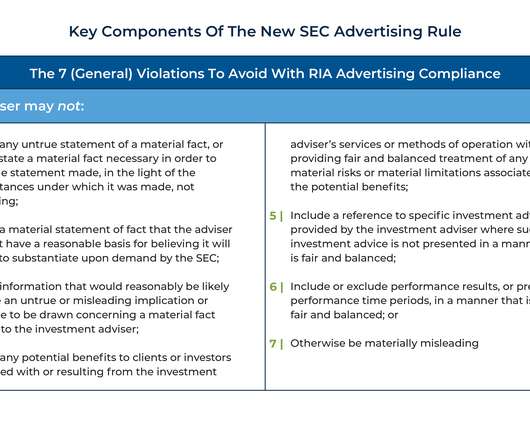

For investment advisers looking to attract prospective clients, advertising the performance of their investment strategies would be a logical way to market their services (at least if they had strong historical returns!). Two final prohibitions under the Marketing Rule include restrictions on the use of predecessor performance (e.g.,

CFO News Room

FEBRUARY 4, 2022

labor market boosted investors’ expectations that central banks will begin steadily raising interest rates to fight inflation. The benchmark 10-year U.S. The spread between the Italian bond yield and the German benchmark, considered a barometer of financial stress in the region, rose to its highest level in over 18 months. .

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content