How to Create Financial Reporting Dashboard for CFO

Spreadym

AUGUST 17, 2023

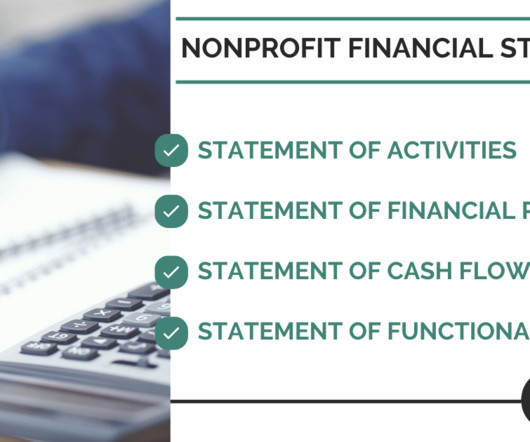

A financial reporting dashboard is a visual representation of financial data and key performance indicators (KPIs) presented in a consolidated and easily digestible format. Decision Making : Financial reporting dashboards enable data-driven decision making by providing stakeholders with timely and accurate information.

Let's personalize your content