Using Cash Flow Forecasting to Withstand the Downturn

Centage

FEBRUARY 2, 2023

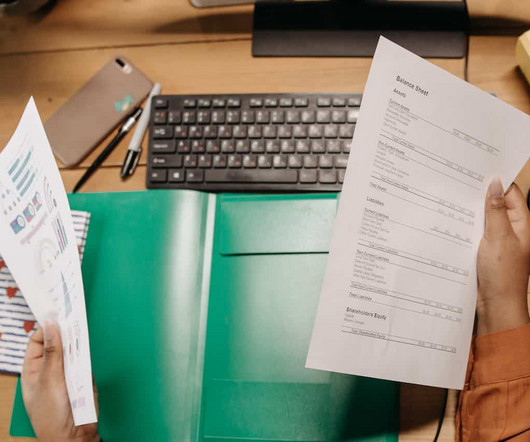

However, one of the most important planning tools for a business of any size is cash flow forecasting – and it’s especially important in times of uncertainty. What It Is and What It Isn’t Cash flow forecasting is building a plan to ensure that you have the liquid assets you need to maintain business operations.

Let's personalize your content