Inflation, Interest Rates and Value

CFO News Room

JANUARY 14, 2023

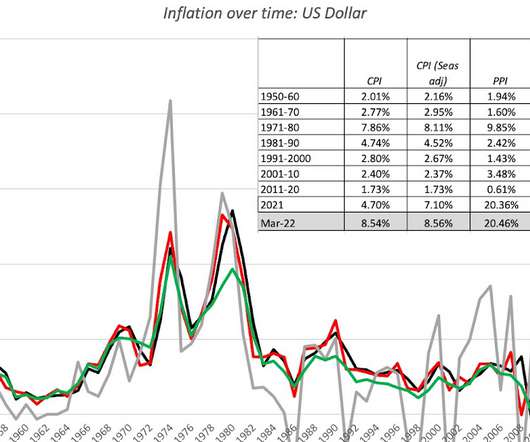

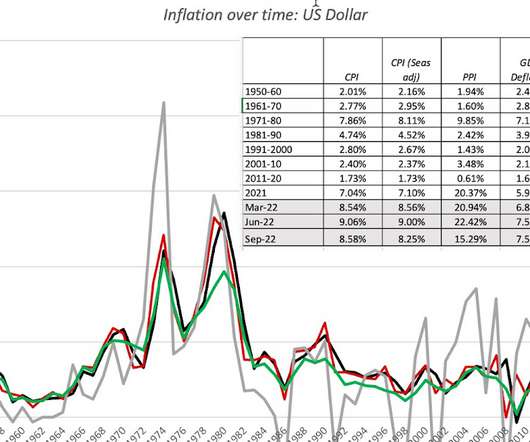

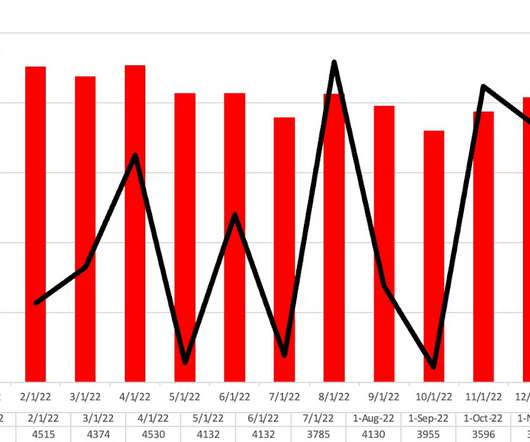

Inflation: The Full Story. I wrote my first post on this blog in 2008, and inflation merited barely a mention until 2020, though it is an integral component of investing and valuation.

Let's personalize your content