Maximizing Efficiency in Financial Management with SaaS Accounting Software

CFO Plans

MAY 16, 2024

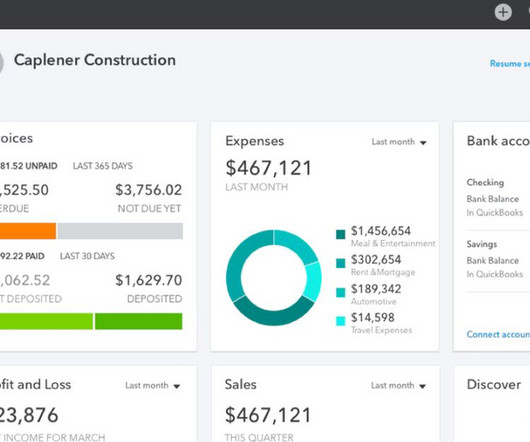

This capability provides CFOs with up-to-the-minute insights into their company’s financial health, fostering more informed decision-making and quicker responses to market changes. Learn About Integration Benefits Security and Compliance in SaaS Accounting Solutions Security is a paramount concern for any financial manager.

Let's personalize your content