The Liability Risk Of Giving Inadvertent Tax Advice (And How To Avoid It)

Nerd's Eye View

JUNE 18, 2025

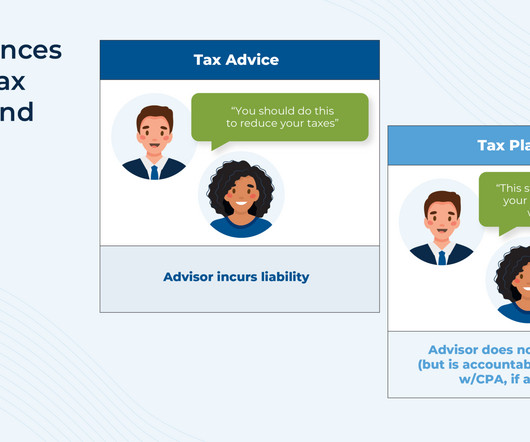

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. Despite this growing interest in tax conversations, most advisors are still quick to distinguish their services as "tax planning", not "tax advice" – a distinction largely driven by liability concerns.

Let's personalize your content