Data Update 5 for 2024: Profitability - The End Game for Business?

Musings on Markets

JANUARY 31, 2024

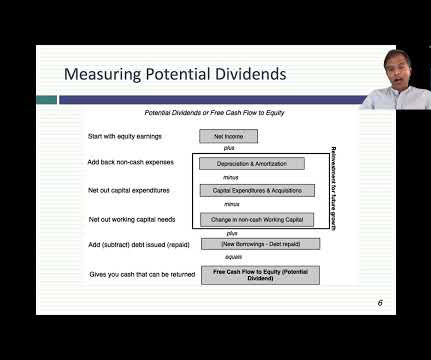

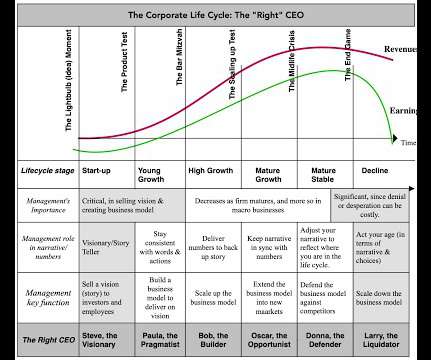

Since businesses invest that capital in their operations, generally, and in individual projects (or assets), specifically, the big question is whether they generate enough in profits to meet these hurdle rate requirements. While private businesses are often described as profit maximizers, the truth is that if they should be value maximizers.

Let's personalize your content