Russia in Ukraine: Let Loose the Dogs of War!

CFO News Room

JANUARY 17, 2023

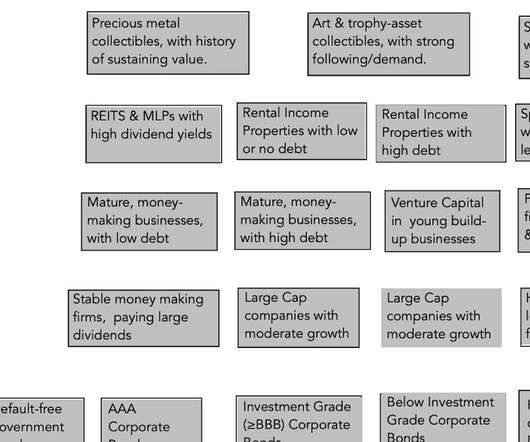

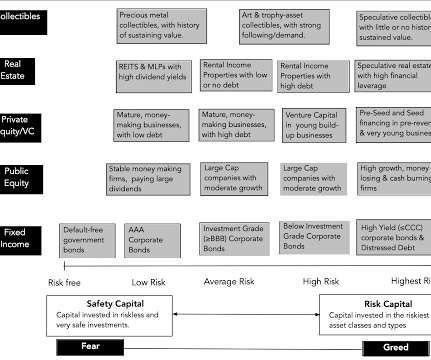

Neither index is particularly representative, and currency effects contaminate both, but they tell the story of devastation in the two markets. I revisited my valuation of the index, with the updated values: Spreadsheet to value the S&P 500. There are two things to note in this valuation. Flight to Safety and Collectibles.

Let's personalize your content