CFOs plan to boost ESG spending despite recession risk: survey

CFO Dive

NOVEMBER 3, 2022

CFOs still aim to spend more on ESG initiatives in 2023 even though they expect economic disruptions to persist until mid-year.

CFO Dive

NOVEMBER 3, 2022

CFOs still aim to spend more on ESG initiatives in 2023 even though they expect economic disruptions to persist until mid-year.

CFO News Room

NOVEMBER 3, 2022

Proactis, the leading Source-to-Pay software solution provider, is pleased to announce that it has been recognised as a Provider to Know by Spend Matters, the world’s largest information source for procurement and supply chain professionals. . Each year the 50 Providers to Know list recognises the best-in-class companies in the procurement and supply chain market.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

NOVEMBER 3, 2022

Over half of executives surveyed said U.S. House and Senate control flipping to Republicans would have positive effects on the business environment.

CFO News Room

NOVEMBER 3, 2022

Executive Summary. For many financial advisors, prospecting efforts have traditionally been based on a perspective of scarcity, where the aim was to focus on connecting with and closing as many prospects as possible, regardless of their actual needs. However, in order to accommodate a wide range of clients with wildly diverse needs, firms often need to provide a myriad of services to address those needs.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CFO Dive

NOVEMBER 3, 2022

Missteps at large accounting firms threaten to undermine investor confidence in financial information, according to Paul Munter, the SEC’s acting chief accountant.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CFO Dive

NOVEMBER 3, 2022

Insider Sonja Theisen will take the top financial seat for the the banking as a service (BaaS) industry leader next year.

CFO News Room

NOVEMBER 3, 2022

The Institute for Supply Management’s composite services index decreased to 54.4 percent in October, falling 2.3 points from 56.7 percent in the prior month. The index remains above the neutral 50 threshold and suggests the 29th consecutive month of expansion for the services sector, but at a somewhat slower pace (see top of first chart). The October results are the lowest since May 2020 and 2.4 points below the ten-year average ending December 2019 of 56.8. .

CFO Dive

NOVEMBER 3, 2022

New owner Elon Musk now has access to sensitive internal communications that could touch on his claim Twitter has more fake accounts than it says it does.

CFO News Room

NOVEMBER 3, 2022

Check out the companies making headlines in midday trading Thursday. Under Armour — Shares of the athletic apparel maker jumped 11.6% after the company reported better-than-expected earnings for its latest quarter, along with revenue that was roughly in line with Wall Street forecasts. Etsy — Shares of the e-commerce platform jumped 12.8% after the company posted third-quarter results that beat expectations.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Barry Ritholtz

NOVEMBER 3, 2022

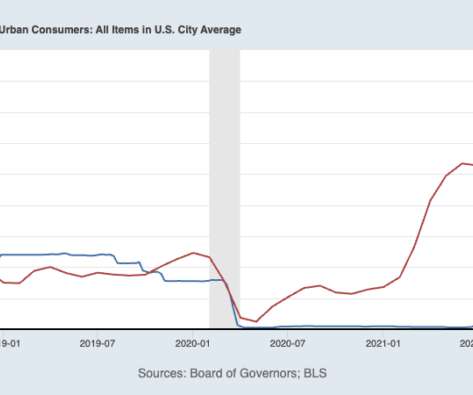

Fed Chair Jerome Powell and the FOMC increased the Fed Funds Rate another 75 bps yesterday, to 3.75-4.0%. Markets have given back much of October’s gains fairly quickly. I have been turning this over slowly in my mind, trying to assess their thinking here. I am not sure what models they use, what data they think is most important, what impact their actions will have, and perhaps most importantly, exactly what they are hoping to accomplish.

CFA Institute

NOVEMBER 3, 2022

When have fixed-income assets actually done what portfolio managers and investors expect them to do?

CFO News Room

NOVEMBER 3, 2022

Company purpose has mainstreamed its way into management vernacular, and with plenty of good reason. Evidence from across industry sectors has proven that genuinely purpose-driven organizations outperform their non-purpose-driven competitors on critical metrics. For example, brands that have a clear commitment to improving their customers’ quality of life outperform the stock market by 120% , and over the last decade, purpose-driven brands have seen their valuation skyrocket by 175%.

Centage

NOVEMBER 3, 2022

Since 1988, BAASS Business Solutions has been delivering sustainable growth and value to small and medium enterprises throughout North America and the Caribbean. We offer a comprehensive range of services and business management solutions that create meaningful experiences for their customers. Q&A with Manny Buigas, Vice President of U.S. & Caribbean Operations.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

CFO News Room

NOVEMBER 3, 2022

James Freeman is assistant editor of The Wall Street Journal’s editorial page and author of the weekday Best of the Web column. He is the co-author of “Borrowed Time: Two Centuries of Booms, Busts and Bailouts at Citi,” recognized as a New York Times Editors’ Choice and a Financial Times Business Book of the Month. He is a contributor to the Fox News Channel and a host of “Deep Dive” on Fox Nation.

The Charity CFO

NOVEMBER 3, 2022

Likely to the dismay of many nonprofit leaders, nonprofit organizations must practically live and breathe bureaucracy to maintain their tax-exempt status and ensure the continuation of their mission. While the Form W-9 for nonprofits is just one more in the constant flow of forms, it has a bright side: it’s fairly straightforward and simple to complete.

Creative CFP

NOVEMBER 3, 2022

Cape Town, South Africa Business advisory firm Creative CFO has recently launched Creative Growth Capital, its very own investment vehicle to meet the high demand for flexible funding solutions that are better geared toward SME business models. Creative CFO has coupled its longstanding expertise in working with SMEs with making flexible investment capital available to SMEs to unlock sustainable growth opportunities and consequently create a positive and measurable impact in more communities in S

Future CFO

NOVEMBER 3, 2022

Southeast Asia’s digital economy is on course to reach US$200B gross merchandise value (GMV) in 2022, three years earlier than projected, said Bain recently when releasing the e-Conomy SEA report - Through the waves, towards a sea of opportunity created by the firm together with Google and Temasek. The report shares an update on how digital economy sectors are tracking across six countries - Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam, Bain noted.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Creative CFP

NOVEMBER 3, 2022

Cape Town, South Africa Business advisory firm Creative CFO has recently launched Creative Growth Capital, its very own investment vehicle to meet the high demand for flexible funding solutions that are better geared toward SME business models. Creative CFO has coupled its longstanding expertise in working with SMEs with making flexible investment capital available to SMEs to unlock sustainable growth opportunities and consequently create a positive and measurable impact in more communities in S

Anaplan

NOVEMBER 3, 2022

Hurricane Ian and the devastation it left behind cost lives and lasting hurdles for the Florida community and economy. Finance experts are warning that the latest major climate event could […].

The Reformed Broker

NOVEMBER 3, 2022

Final Trades: Waste Connections, Boeing & Zillow from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Strategic Treasurer

NOVEMBER 3, 2022

Session 73. Coffee Break Session: What Is Debt Funding? What is debt funding? Coffee Break Session Host Jason Campbell catches up with Strategic Treasurer’s Senior Advisor, Paul Galloway, to discuss debt funding. They discuss what it is, why a company would issue debt, types of debt instruments issued, and the limitations of what can be issued. Listen in and learn a little bit about debt funding.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Fox Corporate Finance

NOVEMBER 3, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Metals & Materials Market Study – 2022”. FCF regularly engages in research on the metals & materials sector based on available data from. Read more. The post FCF Metals & Materials Market Study – 2022 appeared first on FCF Fox Corporate Finance GmbH.

Nerd's Eye View

NOVEMBER 3, 2022

For many financial advisors, prospecting efforts have traditionally been based on a perspective of scarcity, where the aim was to focus on connecting with and closing as many prospects as possible, regardless of their actual needs. However, in order to accommodate a wide range of clients with wildly diverse needs, firms often need to provide a myriad of services to address those needs.

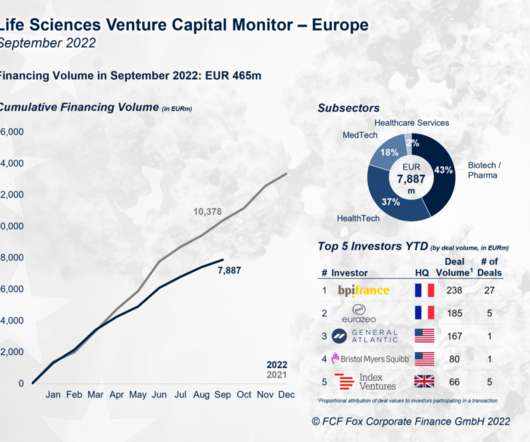

Fox Corporate Finance

NOVEMBER 3, 2022

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Life Sciences Venture Capital Monitor – Europe 09/2022”. The Monitor is a monthly published overview of venture capital trends in the European Life Sciences. Read more. The post Life Sciences Venture Capital Monitor – Europe 09/2022 published appeared first on FCF Fox Corporate Finance GmbH.

CFO News Room

NOVEMBER 3, 2022

If you’re looking for a simple life insurance policy that you can obtain quickly and for the lowest possible premium cost, you need to check out Ladder Life. They offer a streamlined, all-online application process that can get your application approved in a matter of minutes. And many applicants will not be required to take a medical exam. But the most unique feature of Ladder Life is the ability to either increase or decrease your coverage, as needed.

Advertiser: GEP

“What should we do about the tariffs?” There’s no straightforward answer — every leader has a different expectation. CFOs want numbers. COOs want action. CEOs want strategy. And supply chain and procurement leaders need to be ready with the right response — fast. That’s why GEP has created a simple three-part framework that will help CPOs and CSCOs brief the board and C-suite with clarity and confidence.

Let's personalize your content