Data Update 2 for 2025: The Party Continued (for US Equities)

Musings on Markets

JANUARY 17, 2025

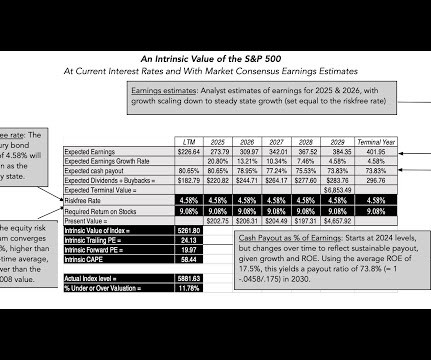

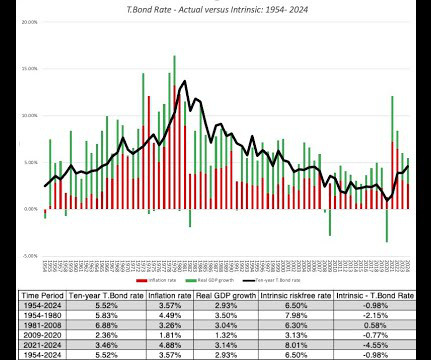

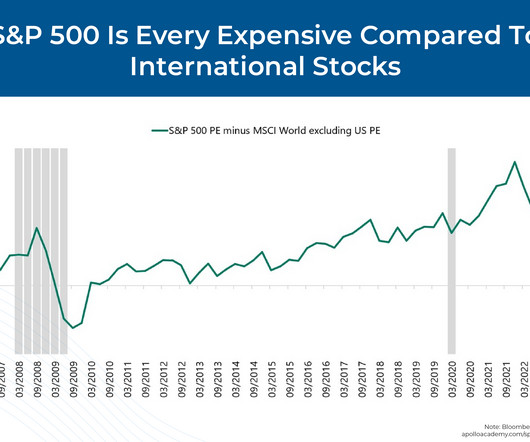

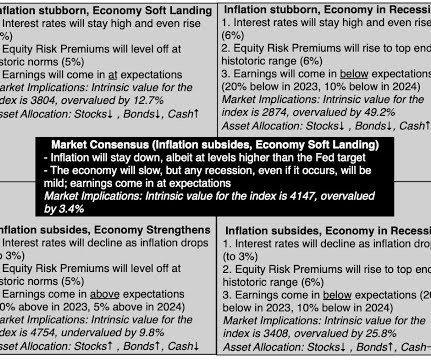

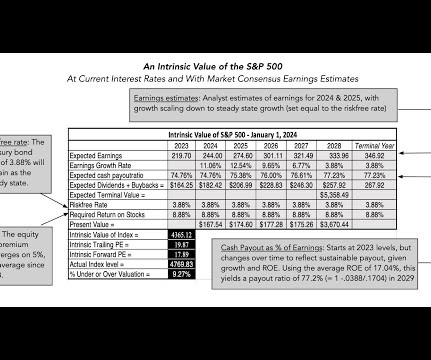

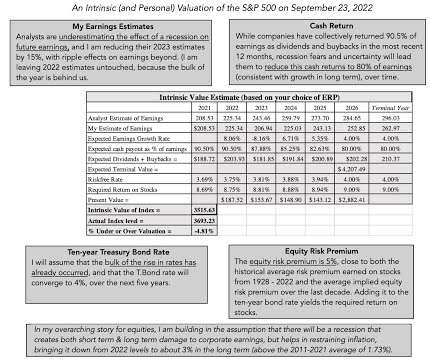

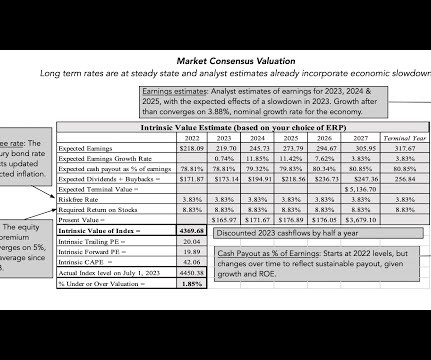

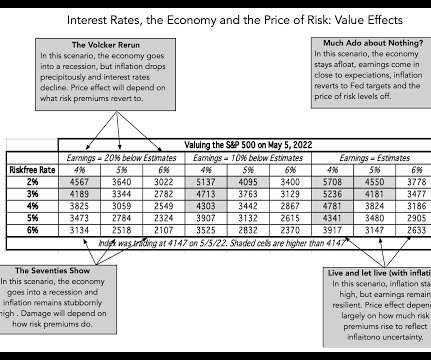

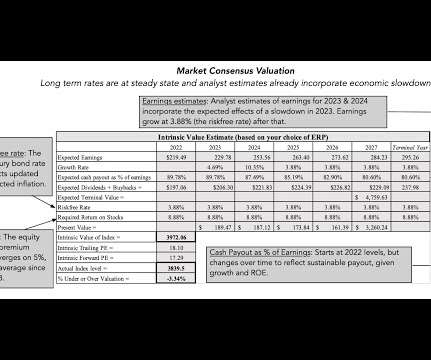

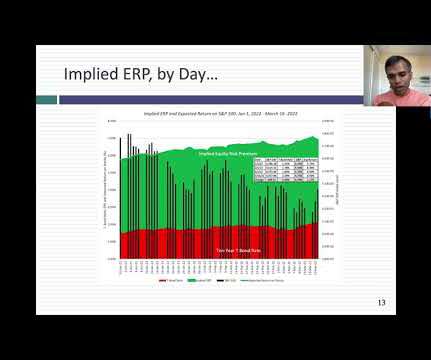

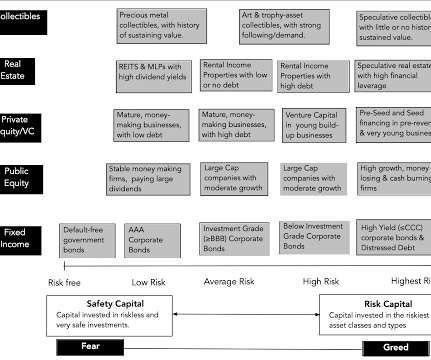

I will follow up by trying to judge where markets stand at the start of 2025, starting with PE ratios, moving on to earnings yields and ending with a valuation of the index.

Let's personalize your content