Risk = Danger + Opportunity!

CFO News Room

JANUARY 20, 2023

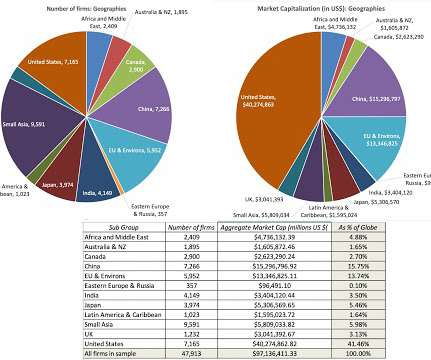

In fact, almost every investment scam in history, from the South Sea Bubble to Bernie Madoff, has offered investors the alluring combination of great opportunities with no or low danger, and induced by sweet talk, but made blind by greed, thousands have fallen prey. Let me use two illustrations to bring this home.

Let's personalize your content