Data Update 4 for 2021: The Hurdle Rate Question!

Musings on Markets

FEBRUARY 10, 2021

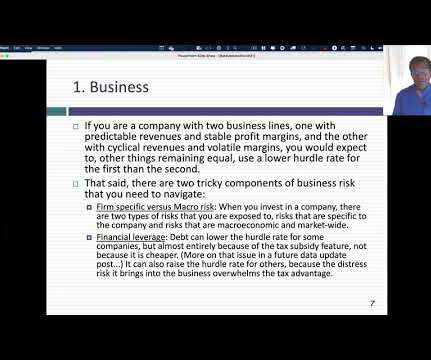

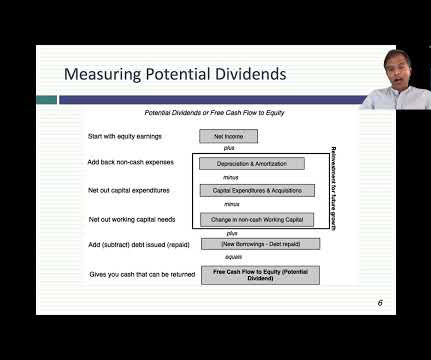

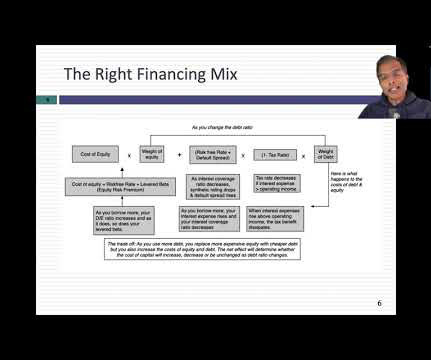

What is a hurdle rate for a business? There are multiple definitions that you will see offered, from it being the cost of raising capital for that business to an opportunity cost , i.e., a return that you can make investing elsewhere, to a required return for investors in that business. What is a hurdle rate?

Let's personalize your content