Data Update 4 for 2021: The Hurdle Rate Question!

Musings on Markets

FEBRUARY 10, 2021

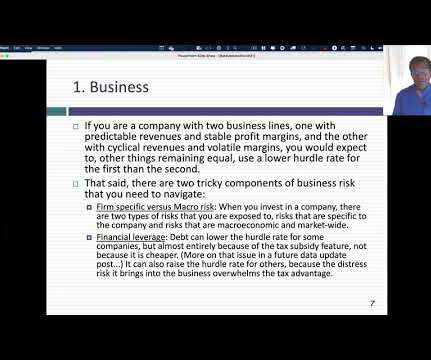

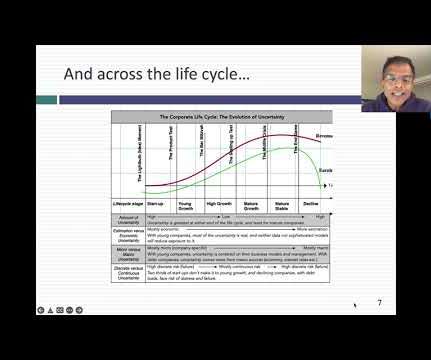

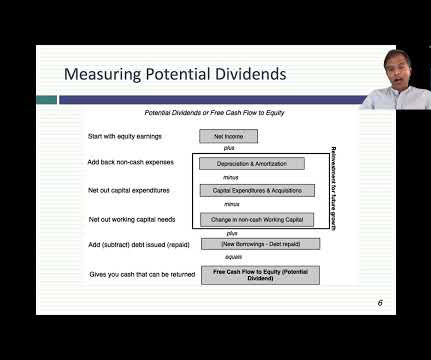

What is a hurdle rate for a business? In this post, I will start by looking at the role that hurdle rates play in running a business, with the consequences of setting them too high or too low, and then look at the fundamentals that should cause hurdle rates to vary across companies. What is a hurdle rate?

Let's personalize your content