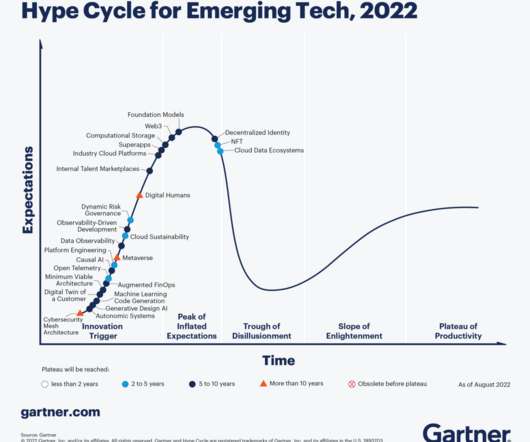

The Hype Cycle, Expertise & Dunning Kruger

Barry Ritholtz

FEBRUARY 9, 2023

Whenever a truly new and innovative technology comes along, there are a tiny number of people who have actual expertise in the space. Where the DK/GHC really overlap is when a new product has a low hurdle rate. I suspect the nexus between them is based on subject matter expertise. See footnote 2, here.

Let's personalize your content