Treasury Inflation-Protected Securities: What Investors Should Know About TIPS

CFO News Room

FEBRUARY 6, 2022

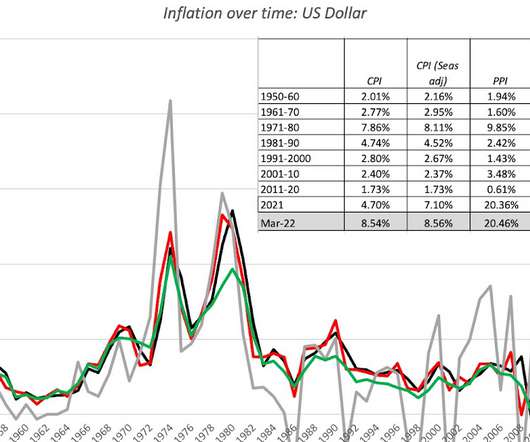

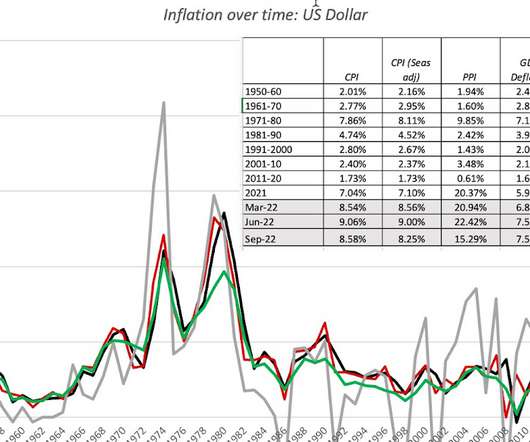

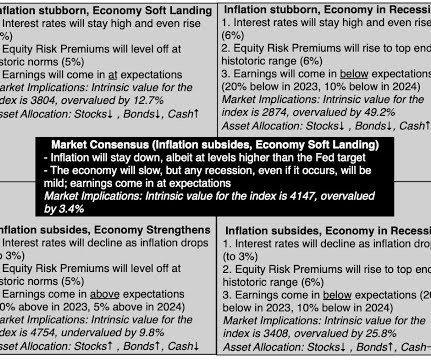

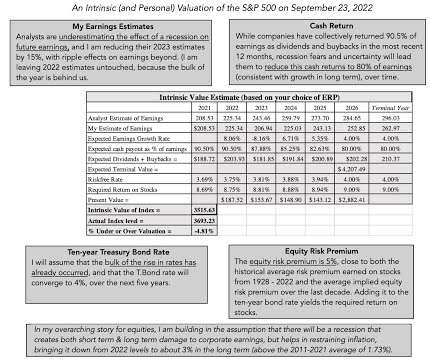

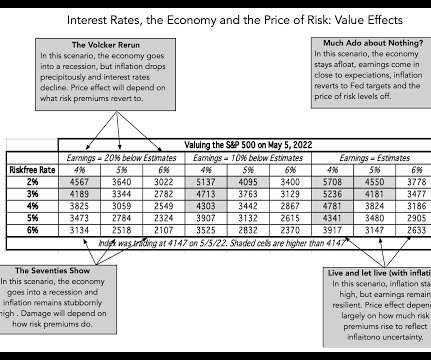

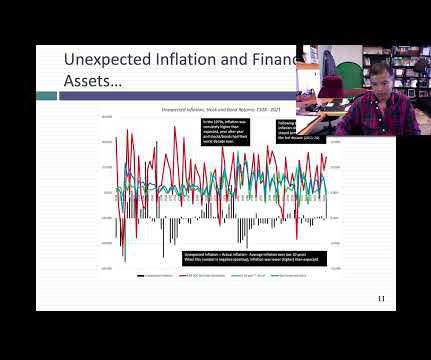

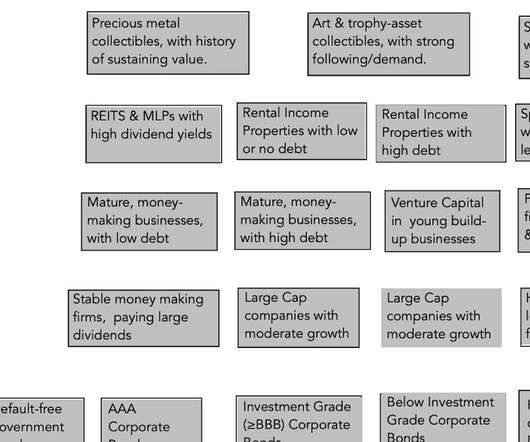

TIPS have suddenly moved to center stage for investors, as the surge in inflation has drawn new interest in Treasury inflation-protected securities. Yes, TIPS may have a role to play in many portfolios, investment pros say. Rising interest rates can hit their valuation. in January to 7% in December. SHARE YOUR THOUGHTS.

Let's personalize your content