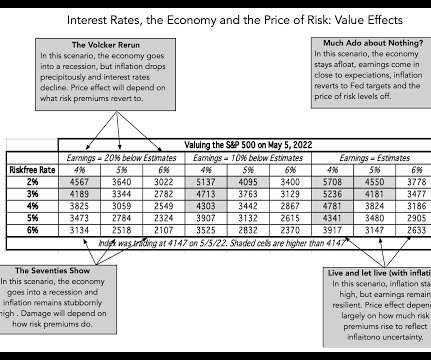

In Search of a Steady State: Inflation, Interest Rates and Value

Musings on Markets

MAY 6, 2022

The nature of markets is that they are never quite settled, as investors recalibrate expectations constantly and reset prices. Investors who are old enough to remember the 1970s point to it as a decade of high inflation, but that is only with the benefit of hindsight.

Let's personalize your content