Understanding the M&A Process Before Making a Deal

CFO Talks

FEBRUARY 26, 2025

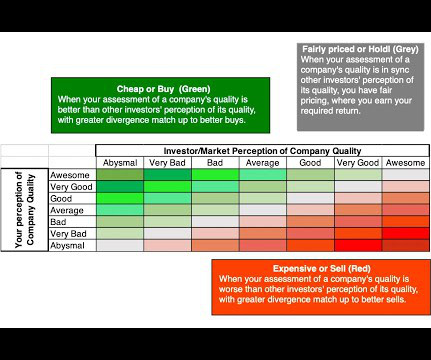

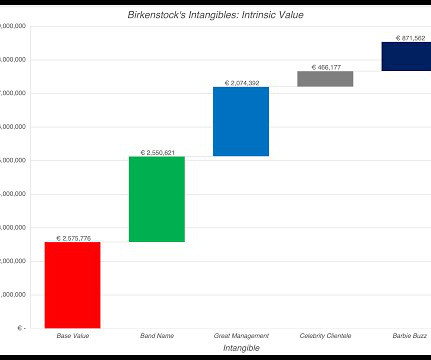

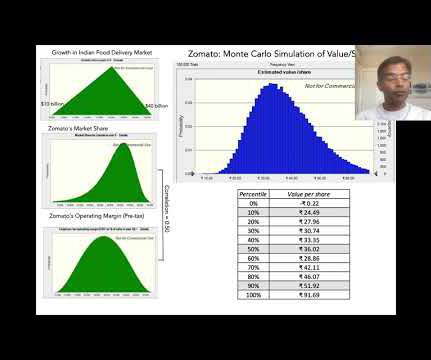

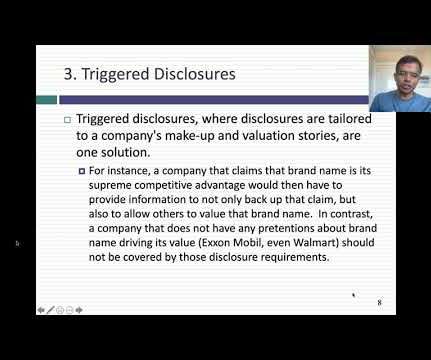

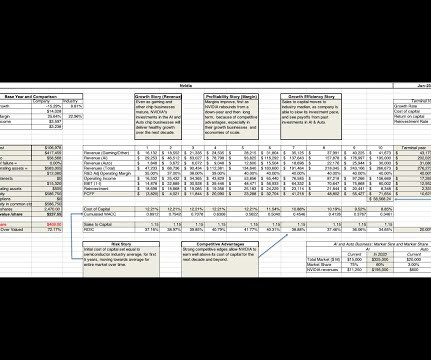

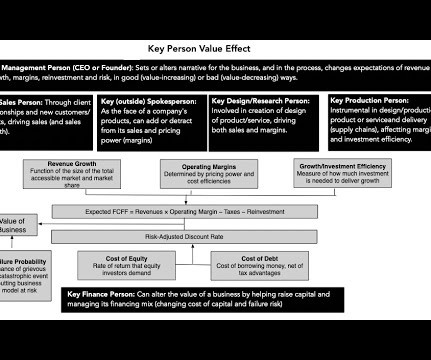

However, a poorly executed deal can cause financial losses, employee dissatisfaction, and even the downfall of a company. Valuation: How to Determine the Right Price A major part of analysing an M&A deal is figuring out how much the target company is worth. Several methods are used to value businesses, including: 1.

Let's personalize your content