Integration Lessons from 2024: Overcoming M&A Challenges to Drive Success

E78 Partners

JANUARY 28, 2025

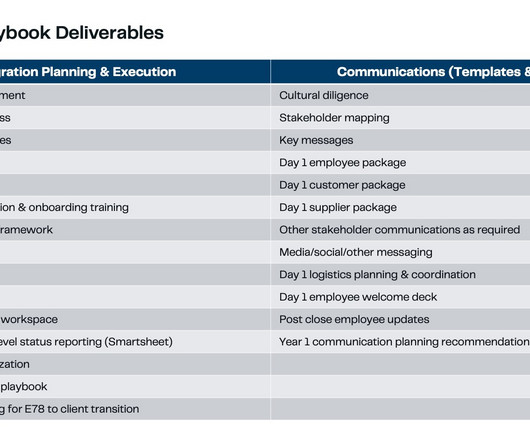

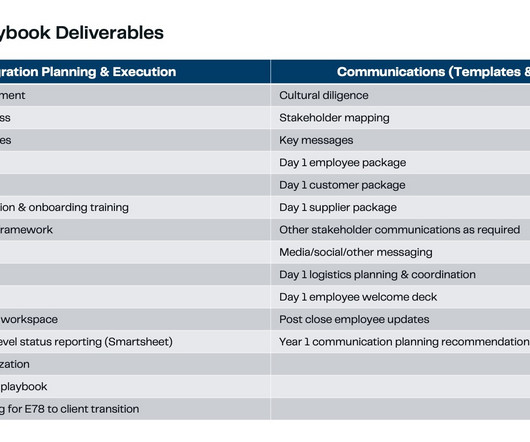

Every year seems to bring a unique blend of challenges for the M&A market, and 2024 was no different. The E78 PMI (Post-merger integration) practice specializes in helping clients overcome the intricate people, process, and technology challenges that accompany mergers and acquisitions.

Let's personalize your content